Table of Contents

If you are reading this, it’s likely that you’re considering the prospect of enhancing your consulting procurement process.

To embark on this consulting procurement improvement journey, irrespective of the extent to which you intend to expand your consulting procurement capacity, it’s imperative to initiate a consulting spend analysis and establish your initial benchmark.

Kickstart Your Consulting Procurement Journey

In the following sections, we will outline the process for creating and enacting an effective framework known as “The Consulting Performance Scanner.” This tool evaluates your consulting expenditures through three key dimensions:

- How much are you spending, who is spending, and on what?

- How are decisions about consulting made from inception to selection?

- What benefits are you getting from your projects and providers?

“The goal is to turn data into information and information into insight.” – Carly Fiorina

The primary objective of this scanner is to furnish you with organized data, enabling you to comprehend the trajectory and trends of your consulting expenditure.

Its utility lies in capturing quick gains, garnering support from your workforce, and embarking on a self-sustained journey of growth.

How Much You are Spending, Who is Spending, and on What

You will need normalized data from your different business units to have a relevant analysis. Besides, unless you already have an ERP that collects information at the right granularity, you might want to define a few dimensions.

We recommend leveraging the organization’s structure to understand who is spending, identify behaviors, establish a list of relevant capabilities for your business, and define a threshold for consulting firms to be a part of the analysis.

As the first scan of your expenses, the simplest observation period usually is the previous fiscal year. This will give you a good basis for slicing and dicing the information.

Data You Need to Collect

- How much did we spend on consulting?

- Who bought consulting?

- What type of consulting did they buy?

- How long were the projects?

- Who did they buy from?

Sources for Your Data

- Invoices, purchase orders

- RFPs

- Supplier information, RFI

- Interviews

How to Organize Your Data

Once you have collected the data, you can prepare an overview of your spend.

- Financials

How much did you spend? How many projects did you do? What is the ratio of revenues? How much did each business unit/division spend? What is the size of the prize if you save 30%?

- Users

What are the functions/business units buying consulting services? Who are the project sponsors? How many times a year? How much did they spend? What type of consulting did they buy?

- Projects

What were the capabilities of your projects? What was the primary purpose? How much did you spend on different projects? How many of the projects were sequels? Are there topics where you seem to overspend? Are there topics where you don’t spend at all?

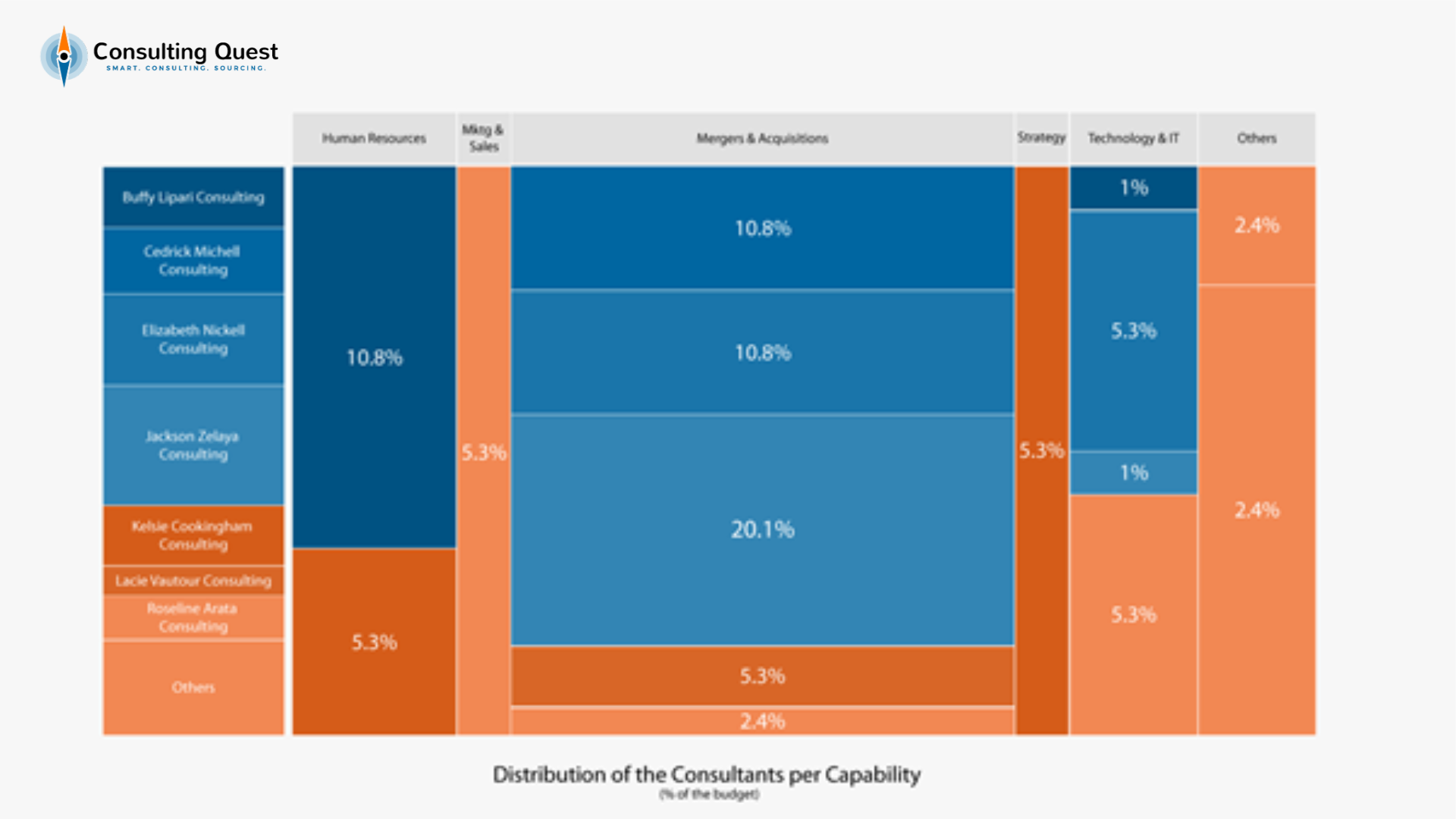

- Suppliers

Who are your suppliers? What is their profile? (size, level of specialization footprint, etc.) Who are the top suppliers? Who are they working with? What are they working on? How much did you spend with each supplier? How many projects did they have?

How Decisions about Consulting are Made from Inception to Selection?

The main purpose of data is to let you understand the problem and give you a clearer, evidence-based picture.

“You can have data without information, but you cannot have information without data.” – Daniel Keys Moran.

Another angle for the scanner is to understand how decisions are made and, in particular, who makes the decisions and what criteria they use.

This data can only be collected by going through all the projects in detail. Like with the spend analysis, organize your data around your organization’s structure and project capabilities.

We suggest using the same threshold to exclude too small projects and base your observations on the same time period.

Data You Need to Collect

- Why did they buy consulting?

- How did they make the decision?

- What validations were required?

- Who is paying? Is it the same person?

- Was a competition organized?

- Was procurement involved?

Sources for Your Data

- Decision workflow

- Interviews

How to Organize Your Data

With the information collected, you should be able to understand how consulting projects are initiated and launched.

- Inception

Who is buying the projects? Why did they buy? Why do they work with consultants?

- Collaboration

Was procurement involved? If yes, who was the point of contact? At what point in the process were they involved? Were there other stakeholders involved?

- Decision-Making

Who is deciding? Who is paying? Is it the same person? What were the validations required? Is there a different decision-making process based on the type of project? The size? The project sponsor?

- Sourcing

Did you organize a competition? Was the competition relevant? Is there a threshold under which there is no competition? Or a unit that never organizes competition?

What Benefits You are Getting from Your Projects and Providers?

So now you know who spends money and how they decide to spend with a particular consulting firm. However, you still don’t know if this was a good investment. There are usually a few dimensions you want to evaluate.

Was the firm qualified to do the job? Have they understood the problem you were trying to solve? Have they worked well with your teams? What were the impact and the return on investment?

Continue to use the dimensions defined for the spend analysis and add some information about the consulting firm structure, particularly the partner and/or the project manager in charge.

Data You Need to Collect

- What are the characteristics of the projects (purpose, length, price)?

- Who were the partners in charge of the project?

- Did the consulting team understand the business?

- Did the consulting team deliver in time, quality, and cost?

- Were the talent and expertise at the level expected?

- Was the posture of the consulting team adequate?

- Was the impact at the level expected?

- Would you recommend this consulting firm for another project?

Sources for Your Data

- Internal surveys

- Internal interviews

- Proposals

- Project documents and deliverables

How to Organize Your Data

You should now have at hand the data to dive into the financials and the impact of your consulting projects.

- Segmentation & Pricing

What were the projects? What was the average price? Length? Are there significant differences by capability? By region? By unit? By supplier? How much did you pay for each project per week? Where does the variability come from?

- Supplier Performance

Was the overall performance at the level expected? What is the variability of the performance? Who are the high and low performers? Per capability? What is the overall performance and NPS for each supplier?

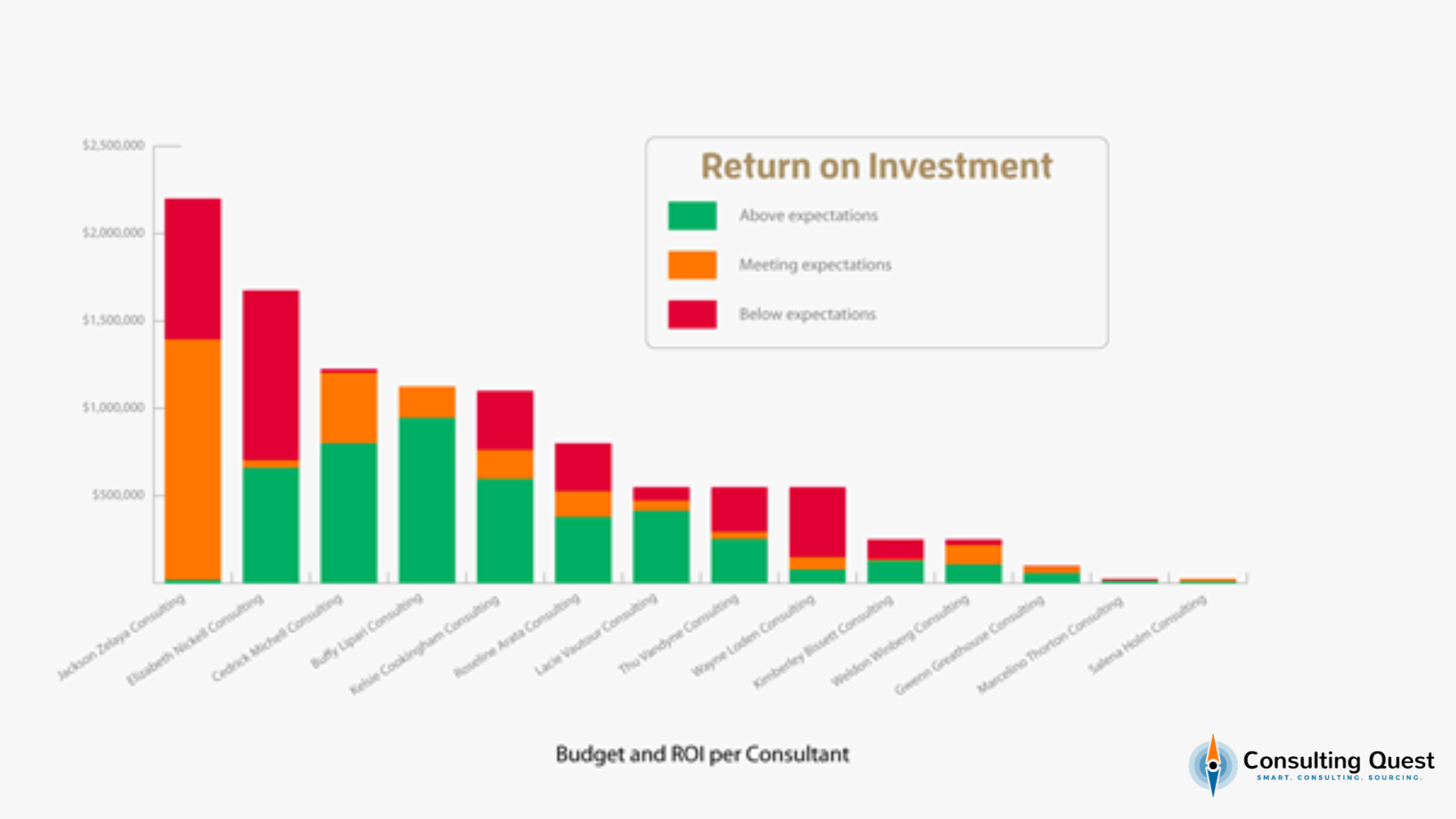

- Return on Investment

Was the overall ROI satisfying? What are the areas (capability, function, purpose, etc.) where the ROI was higher? Lower? What went wrong on the projects with the lowest satisfaction?

Harvest the Quick Gains of Your Consulting Spend Analysis

You don’t need to launch a company-wide transformation to get started. Once you have understood your consulting spend and assessed the performance of your consulting suppliers, you can start raking in the quick gains.

#1. Leverage Your Data

With the diagnosis, you are now armed to define several corrective actions to get you immediate results and savings.

Slice, dice, find patterns and identify outliers. Is there a function or a business unit spending way more money on consulting?

You might also find that some consulting providers are two times more expensive than others on similar projects or that the same consulting firms are charging more in Europe than in North America.

Understanding your portfolio of projects gives you the cards to define the basis for improving your sourcing. You can identify segments and identify thresholds.

If you have an internal consulting group, you can explore how your teams work with this group. Why do your teams work with them (or not)? How is their pricing compared to external providers? Do they collaborate properly?

You know the demographics and performance components of your panel of consulting firms inside out.

You can improve this panel by getting rid of the low-performers, bringing in new blood, playing on supplier diversity, and identifying potential synergies across groups and business units.

Lastly, you can refine the analysis of your consulting spend and focus on the elements that are crucial for your company. This regular analysis can become long-term monitoring of your consulting expenses.

#2. Improve Your Sourcing Process

Among the key success factors for a project, outsourced or not, you will find, at the top, the clarity of the project’s scope and objectives and the team’s talent. It is not different for a consulting project.

To maximize the chances of success of your project, you need to make sure that you have a great RFP that clearly states the project’s context and the goals and deliverables of the project.

Be careful to describe the results you are expecting and not necessarily the means to get them. Another important aspect is to put your consultants in competition when it is relevant (hint: most of the time).

One consulting firm can be great on a project but not be the best choice for the next project. Besides, you might want to look at new ideas or compare other approaches.

#3. Implement Demand Management

Finally, you need to take control of your expenses, particularly when you have a decentralized consulting procurement process.

Loud statements of intent are very rarely efficient. You need to have a clearly defined and objective decision-making process to ensure the budget for consulting is spent on your priorities.

Demand management will help you balance and strategically align demand with your consulting budget. A simple scan of your consulting expenses can open the door to significant quick wins and value creation.

So far, you have learned how to plan and prepare to launch your new consulting project. To understand how well your organization sources and manages consulting, you can use “The Consulting Performance Scanner.”

To complete the picture and upgrade your consulting procurement, you need now to look at the maturity of your consulting sourcing capability.

5 Takeaways for Busy Executives

- Most companies don’t have a clear view of how they are spending their consulting budget.

- Analyzing your consulting spend will provide insights on who buys consulting, from whom, and why.

- Besides the spend, also look at the decision-making process.

- The analysis should help to identify low and high performers.

- Quick wins can be achieved by pruning non-strategic projects and focusing on the best ROI.