Table of Contents

Spend analysis is a valuable tool for clients looking to optimize their consulting spend. Moreover, spend analysis helps clients understand where their money is going, and how they might be able to save by making better choices with their spending.

However, this can be a challenging task – it’s not always easy to get accurate information on spending, or to figure out where savings could be made. In this post, we’ll look at the definition of spend analysis for consulting, the different types of spends, how to practically implement it, and much more.

So, let’s get started!

What Is Spend Analysis in Consulting?

In the consulting world, spend analysis is the process of looking at your company’s spending to find ways to save money. Spend analysis can be a very useful tool for the consulting category, even though it might be hard and may take a long time to do.

If you look closely at how your company spends money, you might find places where you can cut costs and improve efficiency. Spend analysis can also arm you with points that you can use to negotiate better prices with suppliers.

Expenditure analysis is a key tool for any procurement specialist in consulting who wants to run the consulting category well, by helping you figure out where and how money is spent.

Spend analysis can be performed in two ways: top-down and bottom-up. Bottom-up analysis entails scrutinizing each individual transaction to identify spending patterns. On the other hand, the top-down strategy examines broad expenditure categories to identify trends.

While each strategy has its benefits, the bottom-up strategy is frequently more successful in locating potential savings.

Explaining the Types of Spending in Consulting

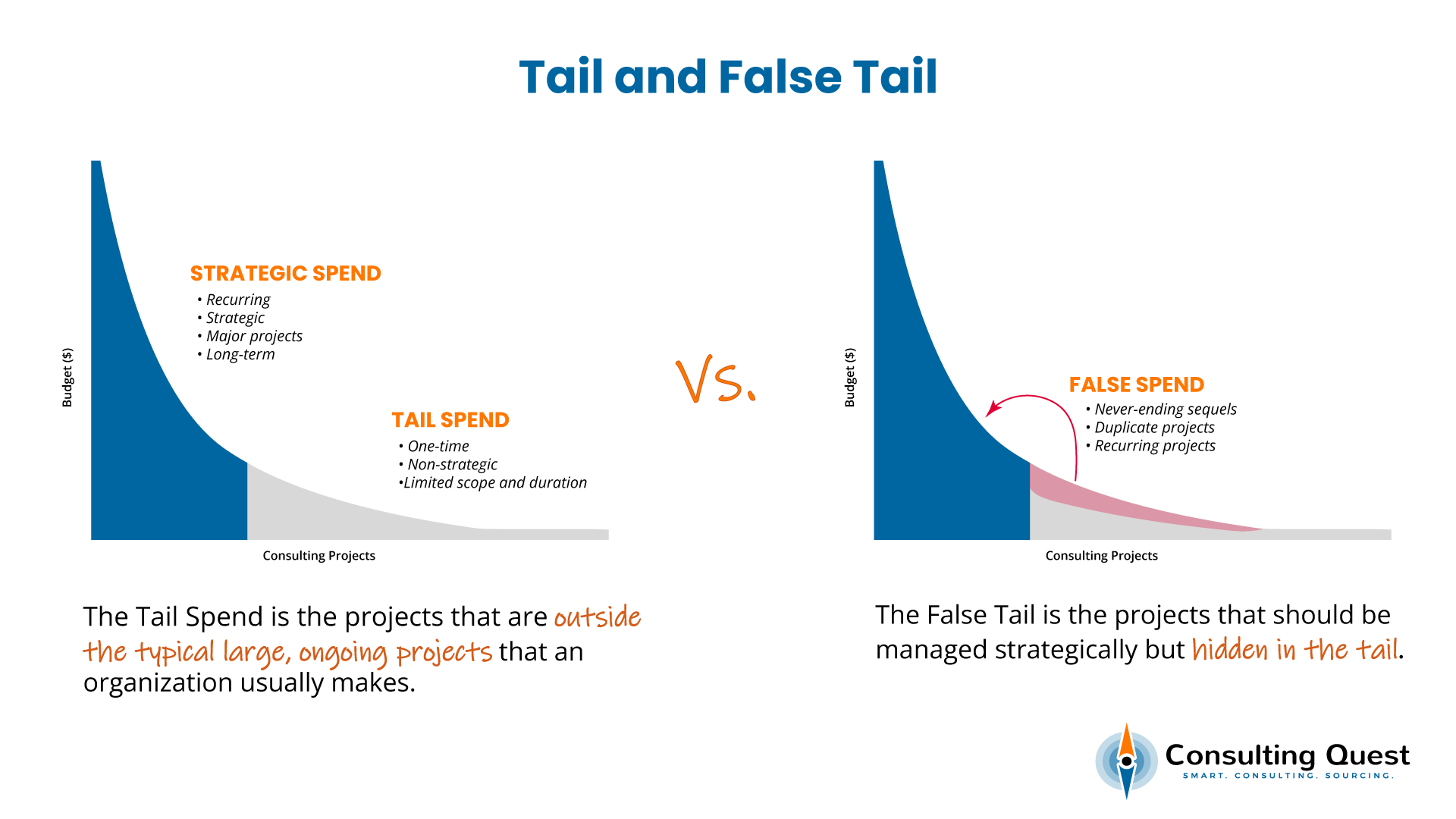

When it comes to consulting spending, not all expenses create equal value. Depending on the return that can be leveraged, we can divide consulting spending into two primary categories — strategic spend and tail spend.

#1. Strategic Spend

The money spent on strategic initiatives and suppliers is known as the strategic spend. Initiatives that support your entire strategy and change is what we are looking at. Generally speaking, consulting spending is strategic by nature as it is directly related to the rate of change and disruption in a given industry or job function.

Strategic spending is a recurring, ongoing expenditure, involving suppliers with whom you spend the lion’s share of your budget. These suppliers are engaged in extremely strategic endeavors and possess exceptionally rare abilities. These are the people with whom you will want to build up a long-term relationship.

The real value of strategic spending comes from the unique skills that strategic suppliers bring to the table. In essence, strategic spending on consulting signifies a big investment for a bigger payoff.

Now, the strategic spend may have a few less-strategic components. These consulting purchases are partly strategic because as an ongoing or recurring expenditure, they help further the overall strategy.

But what differentiates them from fully strategic spending is that they require less specialized talents or suppliers with non-unique skills for which other options can be available. HR or operational excellence programs can be included in this category.

#2. Tail Spend

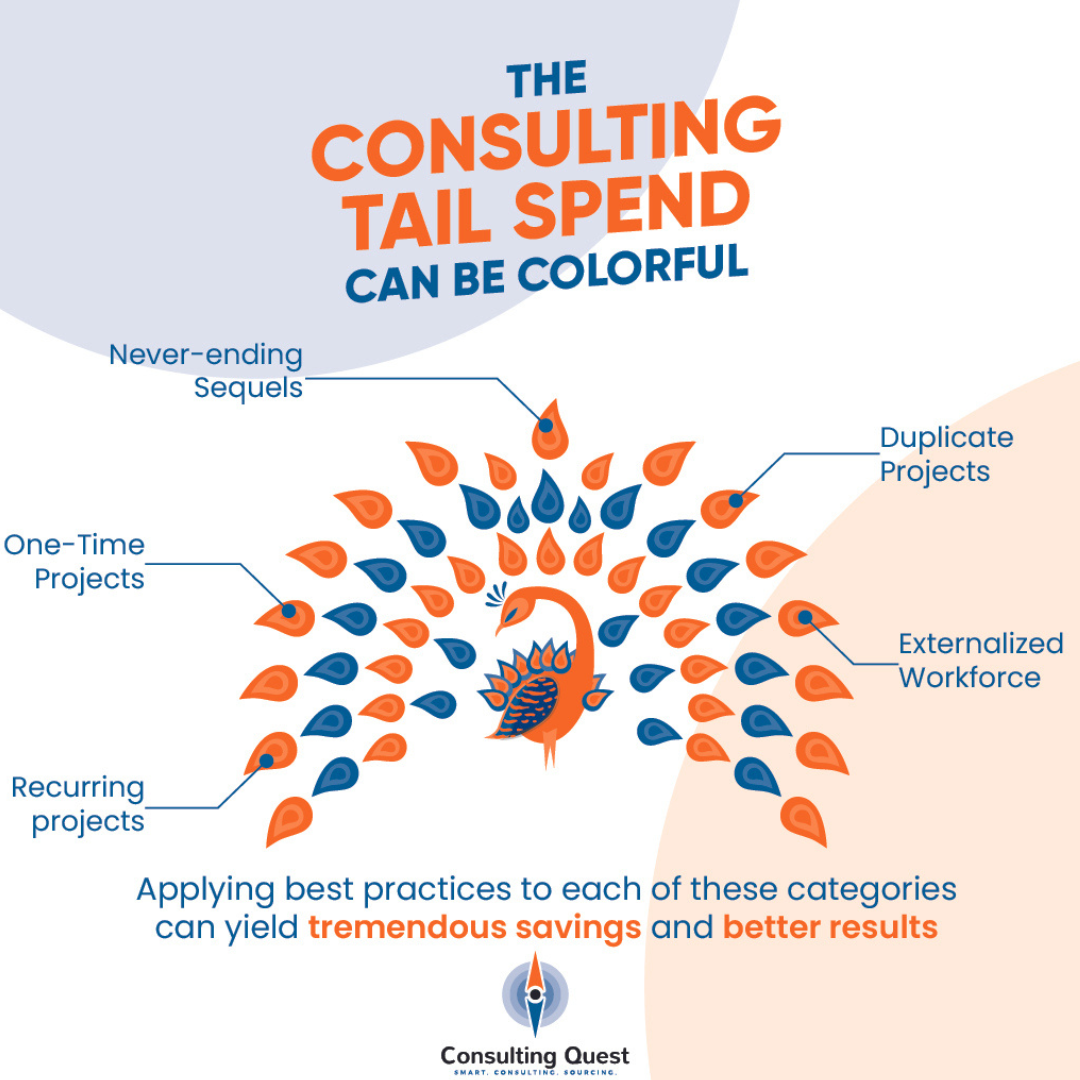

The tail spend is the area where cost savings may start. They often consist of an array of fragmented, low-cost, one-time, often non-critical purchases that is not actively managed in a given spend category and mostly happens outside the realm of organized strategic purchases. Even then, they still have an impact on the performance of the Company through the Cost of goods sold (COGS) or Sales and administration (S&A).

It may represent a small portion of the spend (usually less than 20%) but may involve a large number of suppliers (sometimes 80% of the entire gamut of suppliers that the company works with). In other words, the tail spend is the final 20 percent of an organization’s spend that is serviced by 80 percent of that organization’s suppliers.

Now, the tail spend is not to be confused with the non-strategic spend, which does not contribute in any way to further the company’s overall mission. There may be some one-time purchases leading to long-term value creation for the project/ company.

Then, you should also take note of another category, known as the false spend, which is actually a strategic spend in disguise. The false tail is made of projects that should be in the strategic spend, but are “hidden” in the tail. Sometimes, the price of a project may be enough to make it go under the threshold and be approved automatically bypassing the hassles of approval cycles.

Based on this system, there is this common practice of cutting big projects into several small ones so that the project value of each comes under the threshold. For instance, a consultant can invoice the client 49,950K€ several times a year, when the threshold is set at 50k€. In this way, sometimes strategic spend can be hidden in the tail spend.

However, some parts of the tail spend are totally unnecessary, and this area is going to be your goldmine for cost-saving. These expenses are often the extension of strategic expenditure in the form of sequels, duplicate projects, and repetitive programs. Duplicate projects happen when different business units run the same project with different suppliers.

Recurring projects are projects that are launched several times a year, sometimes with different suppliers. Sequels are the continuation of previous projects. Since these projects are not managed systematically, they end up in the tail spend category. Since they are mostly duplicate in nature, you can easily get rid of them and save a significant amount.

How to Implement Spend Analysis?

We will describe here below how to design and implement a smooth framework that we use or clients: “The Consulting Performance Scanner” that screens your Consulting Spend based on three dimensions:

- How much you are spending, on what and who is spending?

- How decisions about Consulting are made from inception to selection of a provider?

- What benefits you are getting from your projects and providers?

The goal of the scanner is to provide you with structured data to understand the trends & patterns of your Consulting Spend. This will help you capture quick gains, get the buy-in of your employees and embark on a self-funded journey.

How much you are spending, on what, and who is spending?

You will need normalized data from your different business units to have a relevant analysis. Besides, unless you already have an ERP that collects the information at the right granularity, you might want to define a few dimensions.

We recommend leveraging the organization’s structure to understand who is spending, identify behaviors, establish a list of relevant capabilities for your business, and define a threshold for consulting firms to be a part of the analysis.

As a first scan of your expenses, the simplest observation period usually is the previous fiscal year. This will give you a good basis for slicing and dicing the information.

What data you need to collect:

- How much did we spend in Consulting?

- Who bought Consulting?

- What type of Consulting did they buy?

- How long the projects took?

- Who did they buy from?

Sources for your data:

- Invoices, Purchase Orders

- RFPs

- Supplier information, RFI

How to organize your data:

Once you have collected the data, you can prepare an overview of your spend.

- Financials

How much did you spend? How many projects did you do? What is the ratio to revenues? How much did each business unit/division spend? What is the size of the prize if you save 30 %?

- Users

What are the functions/business units buying Consulting Services? Who are the project sponsors? How many times a year? How much did they spend? What type of Consulting did they buy?

- Projects

What were the capabilities of your projects? What was the primary purpose? How much did you spend on the different projects? How many of the projects were sequels? Are there topics where you seem to overspend? Are there topics where you don’t spend at all?

- Suppliers

Who are your suppliers? What is their profile (size, level of specialization footprint, …)? Who are the top suppliers? Who are they working with? What are they working on? How much did you spend with each supplier? How many projects did they have?

How decisions about Consulting are made from inception to selection?

The main purpose of data is to let you understand the problem and give you a clearer, evidence-based picture.

Another angle for the scanner is to understand how decisions are made and, in particular, who is deciding and what are the decision criteria.

This data can only be collected by going through all the projects in detail. Like for the Spend Analysis, organize your data around your organization’s structure and the project capabilities. We suggest using the same threshold to exclude projects that are too small and base your observations on the same period.

What data you need to collect:

- Why did they buy Consulting?

- How did they make the decision?

- What validations were required?

- Who is paying? Is it the same person?

- Was a competition organized?

- Was procurement involved?

Source for your data:

- Decision Workflow

- Interviews

How to organize your data:

What we are getting from this info.

- Inception

Who is buying the projects? Why did they buy? Why do they work with Consultants?

- Collaboration

Was the Procurement involved? If yes, who was the point of contact? At what point in the process were they involved? Were there other stakeholders involved?

- Decision Making

Who is deciding? Who is paying? Is it the same person? What were the validations required? Is there a different decision-making process based on the type of projects? The size? The Project Sponsor?

- Sourcing

Did you organize a competition? Was the competition relevant? Is there a threshold under which there is no competition? Or a Unit that never organizes competition?

What benefits you are getting from your projects and providers?

So now you know who spends money and how they decided to spend with a particular consulting firm. But you still don’t know if this was a good investment. There are usually a few dimensions you want to evaluate on.

Was the firm qualified to do the job? Have they understood the problem you were trying to solve? Have they worked well with your teams? And last but not least what was the impact and the return on investment?

Continue to use the dimensions defined for the Spend Analysis, and add some information about the Consulting Firm structure, in particular, the partner and/or the project manager in charge.

What data you need to collect:

- What are the characteristics of the projects (purpose, length, price)?

- Who were the partners in charge of the project?

- Did the Consulting Team understand the Business?

- Did the Consulting Team deliver in time, quality and cost?

- Were the Talent & Expertise at the level expected?

- Was the posture of the Consulting Team adequate?

- Was the impact at the level expected?

- Would you recommend this Consulting Firm for another project?

Source for your data:

- Internal Surveys

- Internal Interviews

- Proposals

- Project documents and deliverables

How to organize your data:

Why are we getting this information for:

- Segmentation & Pricing

What were the projects? What was the average price? Length? Are there significant differences by Capability? By region? By unit? By supplier? How much did you pay for each project per week? Where does the variability come from?

- Supplier Performance

Was the overall Performance at the level expected? What is the variability of the performance? Who are the High- and Low Performers? Per Capability? What is the overall Performance and NPS for each supplier?

- Return on Investment

Was the overall ROI satisfying? What are the areas (capability, function, purpose, …) where the ROI was higher? Lower? What went wrong on the projects with the lowest satisfaction?

How to Create Value from the Spend Analysis?

Now that you are aware of how you spend and with whom, how choices are made, how you make purchases, and how your consulting providers perform on your projects, it’s time to turn your consulting spend analysis into value. There are a few ways to do that!

#1. Leverage the Data from your Consulting Spend Analysis

You have conducted an initial evaluation of your consulting expenses. You are aware of how much you spend on consulting, why you hire consultants, and how you make decisions.

To accelerate your change, you need to generate instant value and savings. This is the most effective method for gaining the support of stakeholders and funding the transformation.

The next obvious step is to engage a data scientist, begin number crunching, add a dash of artificial intelligence and a healthy dosage of machine learning, and so forth. Sounds fashionable, right? Yes, you may do so.

However, there are many things that can be accomplished utilizing traditional methods. We have highlighted 4 immediate initiatives for your consideration.

#A. Slice, Dice, and Tackle the Outliers

Spend some time digging into the data to find patterns and things that don’t fit. Discrepancies in how money was spent or how things were done are often signs that something went wrong. Let’s go over the most common things that happen.

One part of the organization is spending more than others

Don’t take your ax yet. It’s not always a bad thing to spend more. What matters is making something of value. Take a look and see if the money is being spent well, if there are ways to save money, and if there are ways to avoid wasting money.

A Consulting Firm is charging more than others

When you look at the numbers, you see that John Doe Consulting charges 40% more for similar projects than your other consulting providers. Or, they might only charge more when they work with Business Unit B, which is your most profitable BU.

Consulting Firms have a significantly lower-performance with Business Unit C

You undoubtedly recall Mrs. Jones, your high school history teacher who was really tough. You had mediocre scores despite being an intelligent and diligent student, whereas your friend had Mr. Bouchart, who was quite pleasant and easy, and earned good grades without doing much work.

People tend to assign grades differently. They may have different priorities or varying levels of appreciation. This is why we constantly recommend to involve different stakeholders, such as the project sponsor and project manager, to evaluate the performance of an assignment. These two may have also had different objectives for the project itself.

#B. Improve Your Panel

Even if you do not have a formal list of favored vendors, you often deal with consulting firms. We will refer to them as your panel for simplicity’s sake. Now, let’s examine how to modernize and prepare the appropriate panel for future issues.

Rationalize Your Panel

The majority of businesses utilize consultants to gain access to their talents and experience that are unavailable in-house. If you have performed a Performance Diagnosis, you have assessed the Performance of each of your suppliers and found the top and bottom performers. You can improve this panel by getting rid of the low-performers and bring in in new blood.

Diversify And Rejuvenate

Executives typically source consulting projects locally. It is primarily due to their lack of Consulting Market knowledge and the fact that the majority of sourcing relies on word-of-mouth and personal networks.

However, the Consulting Industry is not a unified bloc. There are regional differences, including in terms of capability. If you are searching for Operational Excellence Experts, you may want to explore in Europe, where businesses are more advanced in this area.

Identify Potential Synergies

Particularly for smaller projects, the potential synergies between different groups or business units are an intriguing aspect of the project portfolio.

You may discover, for instance, that you have purchased the same project multiple times across your organization. Depending on the feasibility, you may want to consider grouping these needs and holding a joint competition in the future.

#C. Prepare the Ground to Improve the Sourcing

Improving the sourcing procedure is an obvious necessity. It begins with defining the segmentation of your projects, optimizing your process, and ensuring that you spend your time and money where it matters.

Segmentation

To maintain efficiency, you need a segmented, differentiated decision-making process. While demand management is concerned with spending strategically, the project’s strategic value is an obvious choice. To further the segmentation, you could also consider the dollar value of a project.

Threshold

Large projects can be initiated without a thorough evaluation of their strategic value if the ceiling is too high. It can have a negative impact on the budget and impede the execution of strategic projects.

If the ceiling is insufficient, business lines will lose control over smaller projects. The team responsible for demand management will be inundated with requests, and strategic projects may be delayed or even abandoned.

The Pareto distribution of your previous project portfolio’s costs and numbers is probably a good place to begin. Then, you will adapt to manage your frustration while maintaining your composure.

Explore the value created by your Internal Consulting Group

Even though a significant portion of internal consulting teams are former consultants, they compensate for their lack of external perspectives by being very familiar with your business and subject matter experts.

Don’t forget to include the projects completed by your internal Consulting Group when scanning your projects. Comparing their Performance to that of your other consulting providers can assist you in appreciating the Group’s contribution and identifying areas for improvement.

#D. Monitor Your Consulting Spend

You won’t realize the benefits of changing your Consulting Procurement Capability unless you routinely monitor its impact. And the financial impact is straightforward to measure.

Define a Target

The best way to make sure you’re still on the right track is to set a goal. You can set a loose goal, such as staying within the limits of X% of the income. You can also choose to set stricter goals for a fixed target.

We suggest setting goals or at least guidelines for the different parts of consulting expenses, both in terms of how much they cost and how well they work and what kind of return on investment you can expect.

In a situation where you are trying to turn things around, you may want to limit consulting projects that don’t show clear benefits (like cost savings, sales growth, etc.) in less than a year. On the other hand, you can relax these rules to plan for the future when your finances permit.

Segment the Expenses

When you look at your consulting spend as a whole, you don’t always get enough information to see patterns and trends. You might want to divide up your costs by:

- The size of the projects: small projects vs. big projects

- The strategic value and effect

- The group handling the procurement process

If you decide to use Demand Management, this segmentation should fit the criteria you set.

Track Everything, Even the Tail

Usually, companies only keep track of consulting expenses that go through the centralized Indirect Procurement group. They think that smaller projects don’t matter when looking at the Consulting Spend.

But if you know about “tail spend,” you know that small expenses can add up to huge amounts if they are not kept track of. Even the smallest consulting expenses need to be monitored.

Create A Monthly Dashboard

Consulting expenses are seasonal, with a peak in the first quarter and a noticeable slowdown in the fourth quarter. While you’re cruising through peak season, be careful not to burn through your consulting budget in three months.

You may need to keep some cash on hand in case of a last-minute strategic project. And to avoid end-of-year surprises, keep track of both expenditures (what you paid) and engagements (what remains to be produced and paid).

#2. Improving Your Consulting Sourcing Process

You’re probably used to making quick decisions as an executive. Given the amount of work you must complete, you cannot afford to delay. You may not always have the luxury of obtaining multiple perspectives prior to making each decision. Nevertheless, when hiring a consultant, it may be prudent to take your time.

When you understand your priorities and why you need to hire a consultant, you can begin searching for the consultant who is the best fit for your project and organization. The most obvious solution is to examine your existing pool of Consulting Providers and choose from among them.

#A. Put Consultants in Competition

Why take the time to organize a competition among Consulting Providers when it would be simpler and quicker to simply hire the person you already know? When you enter an Electronics store to purchase a television, are you just looking for the same television that you have at home? Most likely not.

You want to compare the features of multiple products, examine the newest and most innovative features, find a television that fits your viewing habits, and get the best value for your money. Why not take the same approach when purchasing Consulting Services?

Comparing Skill Sets

Obviously, it is vital to find a consultant with extensive expertise, inventive problem-solving abilities, and outstanding interpersonal skills. But how would you know the amount to which someone possesses these qualities if you do not have someone to compare them to?

Suppose you meet one consultant whose impromptu pitch excites you. You may be tempted to hire him to avoid meeting too many consultants, hearing their pitches, and reading their proposals. Ultimately, this will need much effort on your part, but it will be worth it.

Getting New Ideas

For instance, suppose you’re attempting to transform your company’s culture and make it one of the best locations for people to work. A consultant may recommend providing staff with little benefits such as tickets to sporting events.

A different consultant may suggest that you alter your interiors to make them more favorable to work. A third might recommend dismantling your organization’s hierarchical structure.

Depending on your company culture and ambition, these new ideas will resonate or not. But you may have not thought about them alone.

Looking for the Right Fit

Many business people believe they should lay aside their emotions and operate solely from a logical, rational perspective. However, your organization has a culture, and a legacy, and it operates with people.

Therefore, when you hire consultants to work with your teams, you want them to take into account where you stand, and collaborate with your teams towards a similar goals.

Getting More for Your Money

Lastly, there is a price advantage that makes consultants competitive. If the experts are aware that you will consider other proposals, they will create and price their offer with the utmost care.

Of course, you could always claim that you will choose the finest candidate regardless of cost, but we are all aware of the expense pressures executives face, particularly operating expenses.

The more favorable the cost-to-value ratio, the simpler it will be to convince your boss or board that this consultant is the best option.

#B. Write RFPs To Your Advantage

A Request for Proposal (RFP) that sings to your prospective suppliers or partners is the best way to demonstrate exceptional execution. Therefore, it is once again necessary to think creatively, even when it comes to RFPs.

As a result of the pressures brought on by innovation and globalization, industries and technology advance and transform swiftly. As you maintain this upward pace, it may be easy to forget the effort of aligning your procurement procedures with the strategic goals and objectives of your company. This error would be expensive.

Your procurement capabilities have a direct impact on your company’s success, regardless of how that is defined, including its bottom line.

Solid, solution-based procurement practices—whether in hiring, outsourcing, purchasing, or partnering—directly contribute to the genuine competitive advantage that your company has worked so diligently to achieve.

View the Process as Seeking Solutions

The first step in thinking beyond the usual RFP box is to remind yourself that you are not making a purchase, but rather solving a business problem.

First, present all the information—the “why, what, and who” details—that will allow your possible supplier or partner to understand your company fully, not just your product or service.

Describe in detail your need for the project and your current understanding of its scope. But leave some room for the consultant to design the best solution for you, based on their expertise.

Reveal Your Company for an Aligned Fit

Many companies feel shy to share too much about their business before the beginning of the project. The truth is that it will be very hard for a newcomer to give you the best customized solution if you don’t give them a sneak peek of your company, your organization, your culture, what you have done before, etc. And if you are wary of confidentiality, that’s what NDAs are made for.

Include the Nuts and Bolts

Finally, finish off your RFP with the nuts and bolts of the process. Specify your criteria for evaluating proposals and awarding the work, the timetable for proposal selection, payment, and penalty information, and the timeline you plan to begin and complete the project – the typical content you still require.

In a nutshell, give enough information to your prospective supplier to assess the reward vs risk to take on this potential project.

#3. Implement Demand Management

It goes without saying that implementing Demand Management necessitates the centralization of consulting expenses or, at the very least, the decision to move forward.

To maintain proper alignment between Consulting spend and Strategy, several organizations have delegated demand management to their Strategy or Transformation team.

This position may be positioned at the Corporate or Business Unit (BU) level. Or both, based on thresholds and organizational structure. A successful rollout of Demand Management requires the following components:

#A. Formalize and Share the Process

Formalize the desired procedure and generate alignment. Methodologies and priority criteria must be transparent and objective in order to allow for effective consolidation and therapy. Once the key stakeholders have been aligned, interact with your staff extensively.

Ideally, you should perform some dry runs on historical data or on your largest units and then refine your methodologies. Then, collect project evaluations and resource needs and establish a start date for demand management.

#B. Choose Your Battles

The best projects are initiated immediately. Other desirable but lesser essential projects are placed in a pool and ranked according to their budget viability. Small initiatives (below the threshold) are left to the management’s discretion (resource permitting).

Any request over a specified threshold must be directed to either the strategic or indirect procurement team. All projects must adhere to strict governance, with the option to terminate those that do not produce adequate outcomes.

#C. Analyze Your Results

At the conclusion of each project, you should direct a post-mortem analysis to evaluate the consulting firm’s performance. You will also determine if the priority criteria were justified, allowing for a cycle of virtue.

Depending on the outcomes, the strategy team will modify the decision-making process, the list of consulting firms, and the procurement team will modify the list of consulting firms available for future work.

#D. Position Your Projects Sharply Over the Course of the Year

The sequencing of the projects and their placement throughout the year is an additional powerful lever that is frequently ignored. Achieving a balance between transformational and short-term projects will help you do more with fewer resources. In other words, certain cost-reduction initiatives can free up sufficient resources to launch a digital transformation.

Lastly, it can be difficult for businesses to finance significant consulting projects during a fiscal year. If costs are incurred in year 1 and results are realized in year 2, the bottom line is affected.

The easiest approach to avoid this bad circumstance is to initiate initiatives after the summer break. With a 60-day payment term, if you accumulate expenditures, they will be spread out over two years, and if you don’t, there is a significant possibility that you will begin paying in January, and the cost-benefit analysis will be favorable.

#4. Take Control of the Consulting Tail Spend

Tail Spend Management can be a major area where procurement groups can save money. Small consulting projects, launched directly by business line managers are often forgotten by companies. But when added up at the company level, they can account for up to 25% of the Consulting Spend. If the tail spend is managed well, a company can save between 5% and 40%.

Mismanagement of tail spend commonly happens due to:

- A lot of different suppliers

- Decentralized purchasing practices in which clients make their own purchases and procurement is less engaged.

- A minimum supplier Qualification

- No or very few performance reviews

- Little or no management of categories

While managing your tail spend, you should start by asking this question “How big is my tail and what is in it?” Next, identify the projects in the tail and group them into sub-categories that are easy to manage.

As an example, you could group them into the following categories:

- Category 1: One-Time Projects

- Category 2: Recurring Projects

- Category 3: Never Ending Sequels

- Category 4: Duplicate Projects

- Category 5: Externalized Workforce

How to Tackle the Tail?

#1. Gather Data on Previous Projects

If your organization is decentralized, you will need help from different parts of the organization to make sure you have “clean data.”

#2. Assess Performances of Providers

Assessing the performance of the providers can be done by interviewing the project sponsors and leaders to identify high and low performers.

#3. Regroup Whatever You Can

Create a frame contract for coaching or an RFP for excellence programs or digital transformation that includes all business units.

#4. Develop Your Knowledge of the Local Consulting Market

Having a list of other providers on hand is a great way to stay in charge of the tail without spending too much time on management.

#5. Rules for the Tail Projects Need to be Tweaked

Set up workflows with the right agile check and balance to identify the false tail. Also, make sure that your internal clients aren’t getting around the principles of demand management by breaking up projects and making your tail spend look bigger than it really is.

#6. Use Vendor Management Systems

Use the best-in-class systems to manage the temporary extra staff. Find, hire, and manage outside talent in line with your policies by automating the process.

How Digital Tools Can Help with Your Consulting Spend Analysis?

Many organizations struggle to get their top leadership on board with their consulting plans and initiatives. One of the reasons for this is that it can be difficult to effectively communicate the value of these programs to decision-makers who are often already stretched thin.

Luckily, we now have digital technologies that can be leveraged to address these challenges. These AI-powered tools can process a huge volume of your spend data, helping your procurement teams to get better visibility into their consulting spends. Also, these advanced analytics can even help you eliminate certain types of tail spend altogether.

Also, there are digital tools that can help take your consulting spend to the next level by making it easier to engage and connect with top leadership. These platforms can provide a space for you to share information about your plans, track progress, and solicit feedback.

Additionally, they can help you build relationships with key stakeholders by providing a venue for open dialogue and collaboration. By utilizing these tools, you can increase the chances of getting buy-in from leadership and moving your consulting plans forward.

Keeping these emerging technology trends in mind, we have developed our proprietary tool, Consource. Currently under its Beta stage, this end-to-end consulting digital procurement software is all that you need to get the most out of your consulting budget.

It has several built-in features including scoping & approvals, strategic sourcing, collaboration & selection, contract management, performance management, impact & spend analysis, supplier management, and consulting strategy category.

To transform your consulting procurement from a cost center to a strategic value-creation lever, Consource is the way forward. It helps in optimizing your workflow by providing faster sourcing, reduces risks, increases collaboration, and identifies the optimal consulting firms to maximize your impact.

Digital tools like Consource are tailor-made for the consulting category as it provides a fully customizable solution and leverages the power of the smart consulting sourcing community. It also aids in lowering costs and maximizing value and is design with confidentiality and security.

5 Takeaways for Busy Executives

- Most businesses tend to not have a clear picture of how their consulting budget is being spent.

- Analyzing your consulting spend will reveal who purchases consulting, from whom, and why.

- Apart from the budget, companies must consider the decision-making process as well.

- The analysis should help in the identification of low and high performers.

- Quick wins can be obtained by eliminating non-strategic projects and focusing on the projects with the highest ROI.