Table of Contents

In the professional services market, both providers and buyers rely on pricing benchmarks. For providers, these pricing benchmark ensure they remain competitive by constantly assessing their performance. Conversely, for buyers, pricing benchmarks serve as a reference point to evaluate the cost against the promised delivery of services. In consulting, pricing benchmarks are especially crucial for procurement teams aiming to maximize value for their organizations.

However, it’s essential to note that while pricing benchmarks play a significant role, they are not the alpha and omega of negotiations in the consulting realm. Consulting is inherently more complex, and price alone is not a reliable indicator of value.

In this article, we will explore the intricacies of consulting value, the challenges buyers face in negotiations, the role of pricing benchmarks for consulting in overcoming these challenges, and the limitations associated with their use in consulting negotiations.

Decoding Value in Consulting

When you are purchasing consulting services, you are paying for the value it brings to you. In consulting, the value created by consultants is the difference between what you can achieve with them versus without them. Consulting’s value can manifest in various forms, ranging from the easily quantifiable, such as cost savings and revenue growth, to the more intangible, like cultural shifts or enhancements in leadership effectiveness.

And then there are the long-term projects, those focusing on strategy or innovation, whose impacts unfold over years, making immediate value assessment challenging. While the Impact and value they create are the ultimate barometer of success in a consulting project, there is no universal practice for measuring the intangible benefits coming from consulting services.

The fact that the consulting industry is characterized by the absence of a standard measure of performance does not help either. In the absence of a framework that not only tracks performance metrics but also facilitates transparent, standardized feedback, buyers go by their recognition of brands.

In other words, how familiar they are with a brand name becomes a yardstick in their selection process. As a result, this selection does not necessarily reflect the quality or effectiveness of a consulting firm’s services.

This complexity of the value assessment differentiates consulting from other professional services, in turn, also making consulting negotiation unique. When it comes to navigating the consulting world, knowledge is your best friend. If you don’t have the knowledge, consultants naturally have the upper hand as they’re experts in their domain, knowing every nook and cranny of their trade. Now, as far as consulting is concerned, ramping up your knowledge is not that easy.

This is a unique consulting industry-specific challenge that can be traced back to the phenomenon of asymmetrical information in consulting. To understand the efficacy of pricing benchmark, we need to first understand the concept of asymmetrical information in consulting.

Let’s delve into this concept to explain why and how it adds to the complexities of the consulting buying process for clients. Imagine you’re out shopping for a computer. You want something that can handle your marathon Netflix sessions and your last-minute work presentations without breaking a sweat. But beyond that, you’re in the dark. The salesperson, however, knows the ins and outs of every model on display. This mismatch in knowledge? That’s asymmetrical information at its finest.

In the simplest terms, asymmetrical information occurs when one party in a transaction has more or better information than the other. George Akerlof, a Nobel laureate economist, first introduced the concept of asymmetrical information in his seminal work, “The Market for Lemons.” In the grand marketplace of life, this imbalance can tilt the scales, affecting not just the price but also the quality of goods and services that are exchanged.

Think about it: when sellers know more about the product than buyers, they can easily mask deficiencies or overstate the value, leading to decisions that aren’t in the best interest of the buyer. This imbalance can skew the market, sometimes causing it to fail entirely. Why? Because trust erodes, and with it, the willingness of buyers to take risks on what they don’t fully understand.

How Consulting Buyers Lose Ground at the Negotiation Table

Consulting services, by their nature, are complex and often tailored to the specific needs of a business. This customization adds a layer of ambiguity in evaluating these services. Clients know they need help to solve a problem or improve their business, but deciphering which consulting firm offers the best solution is where the challenge lies. Information about the effectiveness, approach, and true value of the services remains predominantly with the consulting firms.

Let’s think about our computer shopping analogy again, but this time, let’s focus on shopping for a new TV. How do you go about choosing from the many models, specs, and features available? Like many people, you probably turn to comparison websites and read through customer reviews.

These resources provide unbiased information and insights from others who have been in your position before, helping you make a more informed decision and compare similar products more easily. However, clients cannot take this informed approach to consulting buying because unbiased, transparent information are out of reach of clients. Information is largely monopolized by consultants.

This unequal distribution of knowledge throws consulting buyers off balance at the negotiation table creating uncertainty and disadvantage for buyers. Consequently, the seller may exploit this information disparity to their advantage, potentially resulting in unfavorable terms or outcomes for the buyer.

Let’s have a look at what consequences this knowledge gap can have for buyers:

- Clients end up making “informed” decisions with incomplete information.

- There can be mismatches between services they actually need and services they procure.

- They either end up in overspending for services they don’t need or underspending and not getting the results they hoped for.

- Stakes are sky high in consulting, and as such a misstep does not just cause financial damage, it goes on to impact strategic outcomes and operational efficiency.

Let us use an example to explain the impact of this asymmetrical information on the consulting buying practices. In a review spanning multiple industries, we observed that a staggering 65% of the consulting budget was dominated by merely two out of 37 suppliers. This intense concentration raises two vital concerns:

- Over-reliance on one or two firms can create a strategic blind spot, potentially missing out on innovations and breakthrough thinking from the broader consulting industry.

- Top-tier consulting firms frequently charge up to 30% more than their Tier 2 or 3 counterparts, even when delivering similar value.

How Can Pricing Benchmarks for Consulting Help Clients Overcome This Imbalance?

Pricing benchmarks in consulting serve as a strategic flashlight, illuminating the often opaque cost structures and helping clients navigate their way to wise investments in consulting services. Here’s a straightforward breakdown of how pricing benchmarks empower clients to make more informed decisions, ensuring every dollar spent enhances their strategic objectives:

While we all love a good deal, in consulting, the lowest price doesn’t always equate to the best value. Think of it as shopping for a TV and a computer – you’re not just looking for the lowest sticker price; you want the best quality and features your money can buy. Similarly, pricing benchmarks enable you to identify what constitutes a fair price for consulting services, ensuring you hire top-notch expertise without compromising on project scope or quality of delivery.

Decision-makers must ensure their investment in consulting services directly contributes to achieving their strategic goals. However, striking the right balance between cost and value is tricky. Are you genuinely advancing towards your strategic objectives, or are your consulting expenses just a budgetary black hole? This is where the clarity brought by a well-crafted pricing benchmark becomes invaluable.

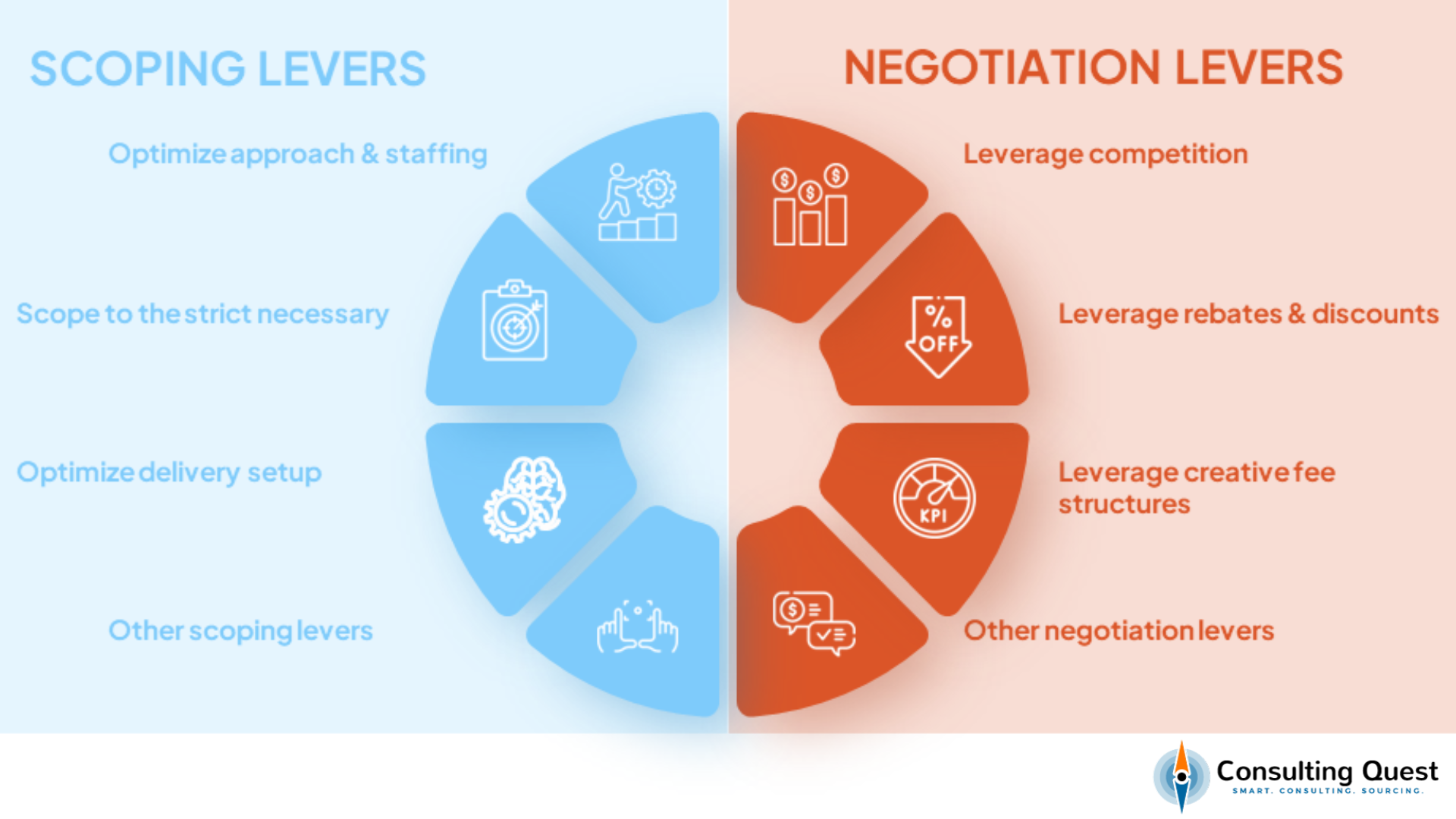

Armed with detailed insights from pricing benchmarks, you no longer have to negotiate in the dark. This knowledge lights up the hidden nuances of consulting costs and pricing, allowing you to engage in negotiations with confidence. It’s not about penny-pinching but about paying wisely – ensuring that your investment is both justified and aligned with your strategic aspirations.

Consulting fees aren’t one-size-fits-all; they swing wildly depending on where you are and what industry you’re playing in. That’s where a sharp benchmark report comes in handy. It slices through the fog, giving you a crystal-clear picture of how fees vary by sector and location. Tailored to fit your specific scenario, this kind of insight lets you tread the market waters with the precision of a seasoned captain.

Digging deeper, we see that the industry you’re in can significantly bump up consulting fees – with some consultants charging up to 50% more for projects in high-stakes fields like Financial Services or Pharma. It’s enough to make any decision-maker pause and wonder, “Are we getting a fair shake on price in our industry?”

So, here are a few ways, benchmarking prices can help you:

- Compare your rates with those across the industry.

- Uncover if you’re inadvertently paying too much for specialized knowledge. Identify potential areas of saving.

- Analyze potential regional cost disparities.

- Navigate the diverse rate structures of different tiers of consulting firms with data-backed insights.

To summarize it all, if you want to turn the tables on asymmetrical information and move from being at a disadvantage to holding your own in the consulting cost conversation, pricing benchmark for consulting services will be a potent weapon at your disposal.

The Limitations of Using Pricing Benchmark in Consulting Negotiations

Pricing benchmarks can be a useful tool in consulting negotiations, provided they are detailed enough to be meaningful. The usefulness of these benchmarks hinges on their granularity. Without this level of detail, benchmarks may not offer much insight.

For example, strategy consultants can command fees up to twice as high as those of operations consultants. Similarly, consulting rates in the United States are typically 20 to 30% higher than in Europe. However, even with accurate, granular pricing information, several limitations persist.

The most significant limitation is the inherent variability among consulting firms regarding their delivery models, performance, and expertise. Consider two consulting firms: one charges an average rate of $2,000 per day, while the other’s rate is $2,500.

When pricing a project, the first firm might propose a team of three consultants for seven weeks, resulting in a total cost of $210,000. The second firm, despite its higher daily rate, might offer a team of four for only four weeks, totaling $200,000. This example illustrates that a higher daily rate doesn’t always translate to a higher project cost.

Moreover, the experience and efficiency of the consulting team can greatly influence the overall value and return on investment (ROI) of the consulting engagement. A team with higher daily rates but more experience can often achieve better results more quickly than a less experienced team.

This efficiency can lead to a better ROI, as the more experienced team’s approach may solve the client’s problem more effectively and expediently, despite the seemingly higher initial cost.

In essence, while pricing benchmarks provide a starting point, they fall short of capturing the full picture. The true value of consulting services is often defined by the specific outcomes and improvements they deliver, not just the cost of the service.

Therefore, when negotiating with consulting firms, it’s crucial to consider factors beyond just the price, such as the firm’s track record, the expertise of its consultants, and the alignment between their proposed solution and your business needs.

Conclusion: Pricing Benchmark in Consulting

In France, there’s a saying that you should conduct your business dealings “as a good family man.” Now, I’ll be the first to admit that it sounds a tad outdated and maybe a smidge paternalistic. So, let’s give it a little 21st-century polish and say, “You should shop for your business like you’re shopping for yourself.”

This means doing your homework, understanding the stakes, diving into comparisons, and weighing the performance—not just on a broad scale but specifically tailored to your needs.

So, how do we tackle asymmetrical information in the consulting realm? It boils down to knowing your market, understanding the services on offer, and really getting to grips with your suppliers. It’s about making informed choices, not just taking a leap in the dark based on glossy presentations or big names. It’s true that the intricacies of consulting procurement can sometimes be elusive, even for the most seasoned among us.

To this end, utilizing pricing benchmarks can be a valuable tool, offering a preliminary validation of daily rates and serving as a starting point for negotiations. However, while they serve as useful guides for establishing general rate expectations and can be starting points for negotiation, they should not overshadow other critical evaluation criteria.

Consultants offer unique value propositions that transcend mere daily rates—factors such as their cultural fit, delivery model, and approach are equally pivotal. In essence, the process of selecting a consulting partner is a comprehensive evaluation that goes beyond numerical comparisons.

It’s about understanding the multifaceted contributions a consultant can make to your business, recognizing that the best value comes from a synergy of factors tailored to your specific needs and aspirations.