Table of Contents

The management consulting industry is a global market. The consultants help companies in various sectors solve problems by applying management theory and business expertise acquired from research through developing concepts, practices, and procedures for implementation across different sectors worldwide.

Did you know that most companies work with consultants based within a 50 miles radius? Let’s see the example of direct purchasing: Would you buy from your local neighbors or take advantage of the worldwide market? How frequently do you usually utilize the same vendors? You’d probably foster competition and ensure that you’re always working with new people.

That prompts the following question: How well do you know the Consulting Industry today? And how can you leverage that knowledge to always source the right consultants for your needs?

The consulting industry is adaptable.

The industry is quite adaptable and has been through rough phases but always recovered. So it will probably be the case again after the pandemic crisis. But the change had already started before 2010, and the wave will continue to strengthen and profoundly modify the industry.

The Global Economy is seeing a shift in the balance of powers

If we merely follow the projections provided by economists, we should see a significant change in the balance of power by 2025 in the global market.

Following a period of adversity, emerging markets and developing economies are now growing at a rate of 2.5 times faster than advanced economies such as the United States, the European Union, and Japan.

The E7 (China, India, Indonesia, Brazil, Russia, Mexico, and Turkey) was only half the size of the G7 (the United States, United Kingdom, France, Germany, Japan) in terms of GDP in 1995.

By the end of the century, it could be twice as big. The two groups are currently about equal in size. However, E7 consulting is expanding swiftly but does not yet approach the level seen in G7 nations.

However, there are a few interesting questions:

- Is there a cultural tendency to rely more on Consultants in Advanced Economies?

- As most decisions are made in central offices, often in Advanced Economies, is it safe to say more money is spent on Consultants there?

- Are organizations in Advanced Economies spending more on Consulting to keep an edge over the competition?

The balance of power is shifting. In the future, global economic growth is expected to drop closer to 3%.

India will soon pass Germany and Japan after overtaking the United Kingdom and France. It appears that India and China will take the top places in no time. Investors should expect a surge of interest from multinational corporations seeking to invest in developing regions with high GDP growth.

As they mature, they will become less attractive for offshore Manufacturing but will present B2B opportunities. After that, they will become investors as China did.

In other words, the global Economy will enter a period of uncertainty and volatility over the next several years as it adjusts to this shift. Meanwhile, mature economies will continue to see slower growth in response to this paradigm shift.

The management consulting industry follows the ups and downs of the Economy

We can see a moderate relationship between GDP and Consulting Growth when comparing these two variables. According to Marc Baaji, three variables can help explain the variations between regions:

- The economic growth of the area will enable the ability to invest.

- The structure of the Economy will show which industries are most likely to spend in consulting.

- The local culture will influence the willingness to collaborate with external partners.

Major Consultancies define their set of megatrends shaping the future of society and the Economy – PWC, for instance, predicts that despite the Economy’s volatility, most of the additional growth will occur in medium-sized cities of developing countries.

The Digital Revolution has a significant influence on nearly every sector and geography. As a result, regional authorities attempt to establish restrictions to regain some degree of control (for example, GDPR or internet access in China).

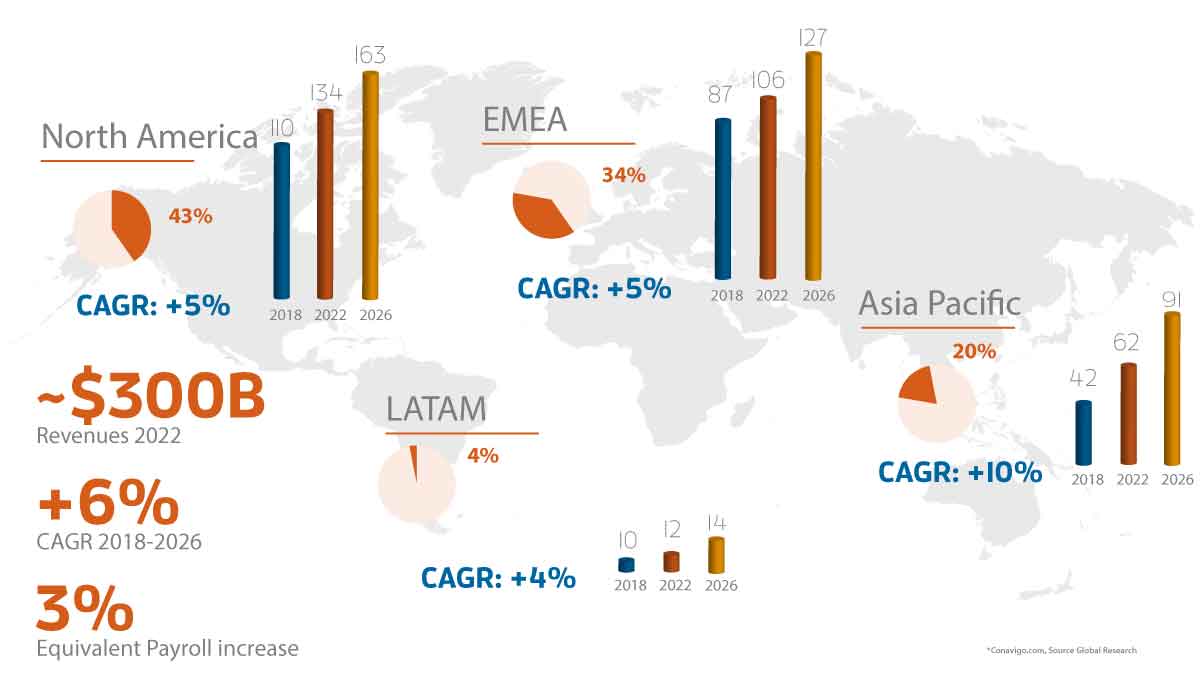

On a worldwide scale, today’s consulting industry is dominated by North America and Europe, making up about 80% of the market. Asia Pacific, Middle East, Latam, and Africa follow in order.

While Asia’s growth rate is twice as quick as North America’s, the North American market is roughly three times the size of the Asian one. As a result, it will probably take another 30 years for the Asian market to catch up at this pace.

While most of the customers join multinational businesses, the consulting industry is still disorganized.

Clients like projects done by local boutiques since they are more attuned to the culture. In addition, teams of two to five consultants undertake many consulting projects that do not require a global presence or footprint.

The management consulting industry is enormous.

The management consulting market is vast and very fragmented. It includes independent consultancies, management consultants working for large corporations (in-house), management consultants working with smaller companies, etc. Thus it can be challenging to get a complete picture of the sector’s size.

What is the size of the Consulting Market?

It’s a difficult question to answer because there are so many different answers. However, you’ll find various market sizing estimations on the market from Statista evaluates $160 billion in 2020 up to Plunkett Research with $500B in 2021.

Why such differences? Because there is no standardized definition of management consulting. We all agree that it includes HR, IT, Strategy, Operations, and Finance consulting.

When you include IT management into management consulting and Engineering consulting, the numbers are much higher. So the truth is probably in the middle.

At Consulting Quest, we define the management consulting industry as the practices of Finance, Technology (including IT strategy), Operations, HR & Strategy. We do not consider engineering consulting, IT management & development.

We estimate the global consulting market to be roughly $300 billion worldwide. So no matter how you look at the market, it is surprisingly huge and almost twice the size of a booming industry such as video games ($155B in 2020).

It is a growing market despite the Covid crisis.

Covid-19 pandemic aside, the Consulting Industry shows a CAGR between 5 and 8%, outpacing GDP in most countries. At this pace, the industry is expected to break the $400 billion by 2025.

During the 1970s and 1980s, the worldwide Consulting market expanded every year, going through two recessions (1971-1973 and 1973-1975). As a result, operational management and strategic services were in high demand throughout this period.

The internet bubble burst in 2002, which was the first contraction. A far worse crisis subsequently hit the industry with the 2008 global financial catastrophe. Since then, the sector has rebounded significantly and is now expanding at a healthy rate.

In 2020, after the outbreak of Coronavirus illness (COVID-19), governments around the world implemented lockdowns and restricted trade and travel, reducing the need for consulting services.

The worldwide economic activity has decreased, while nations have gone into lockdowns,’ and the adverse impact on enterprises persisted throughout 2020 and into 2021.

The downturn, however, is not expected to last long. Even though the management consulting sector has endured a severe blow, it is anticipated to recover in time. The crisis is not structural; rather, it stems from external factors.

Its structure is unusual.

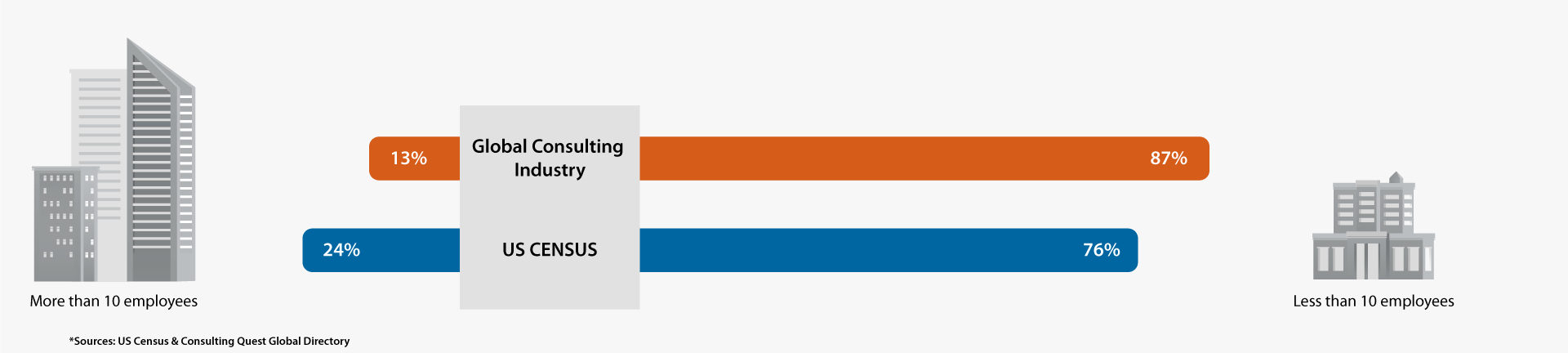

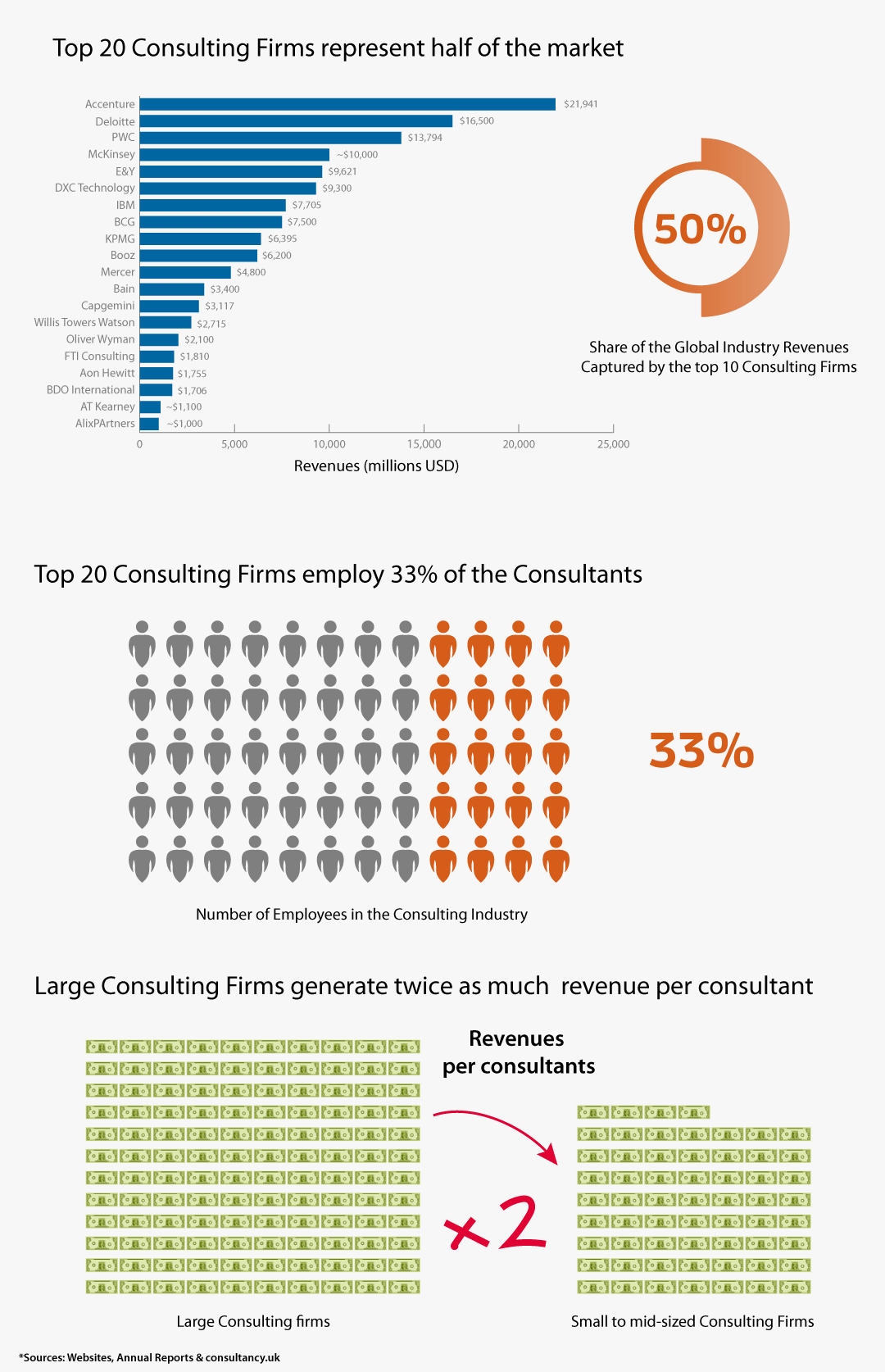

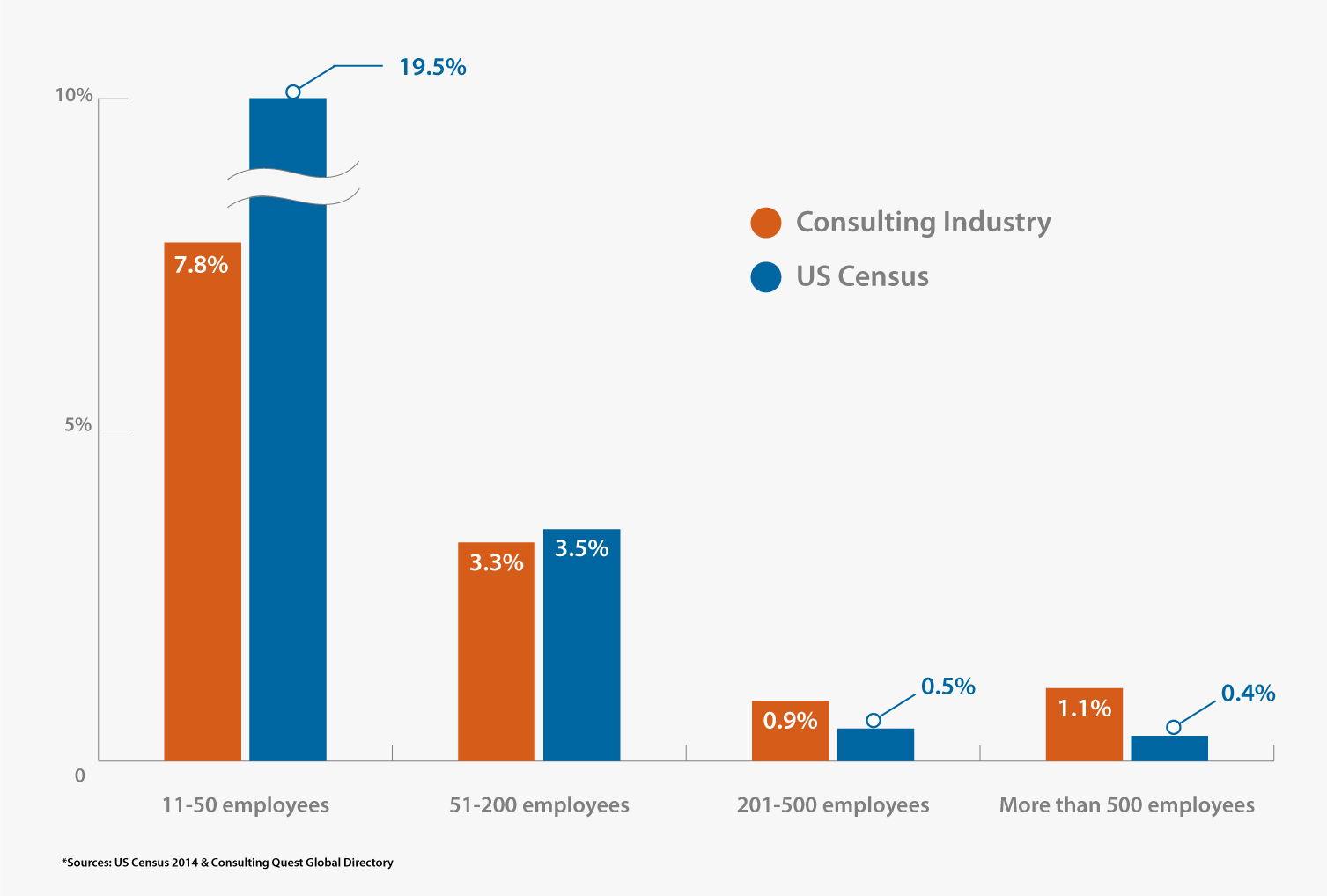

The size of consulting firms is another approach to the complexity of the market. We can then understand how counterintuitive the distribution is.

Management consultants come in a variety of shapes and sizes. Management consulting is a broad field with many different types. Large businesses generally provide a wide range of services, while small companies typically specialize in a specific area.

Small boutiques with fewer than ten employees account for the vast majority of consulting businesses. They make up 87 percent of all Consulting Firms in the United States, a bit more than the overall US Census Bureau average of 76%.

The most counterintuitive of all: the remaining 13% of Consulting Firms with ten or more employees capture over 90% of industry revenue.

When you look at where the employees work, you’ll notice the same pattern. More than 60% of consultants work in businesses with fewer than ten workers, usually sole practitioners.

Large businesses hire 33% of all consultants worldwide and make half of all management consultancy income. As a result, revenues per consultant for large enterprises are twice that for small companies.

A very active M&A front has shaped the industry.

Since 2006, we have observed around 500 management consultancy firms being acquired or merged with more prominent players in the consulting industry each year.

These decisions may be motivated by a desire to broaden one’s customer base, explore new skills or industries, or enhance an established operation. As a result, the state of continuous M&A activity shaped the Consulting Landscape.

Compared to the average, there are 60% fewer little businesses with less than ten employees and almost three times as many firms with more than 500 employees in the Consulting business.

Why does the consulting business have such a poor reputation? Is it because consultants are providing anything to the table? Perhaps value?

What value do Consulting Firms bring to their clients?

We are only at the beginning of a long and exciting road. However, we can already see how complex the market is. In terms of size, footprint, and services, the range of Consulting Organizations appears to be all over the place. This is why purchasing consulting services is so difficult.

Value can take two forms.

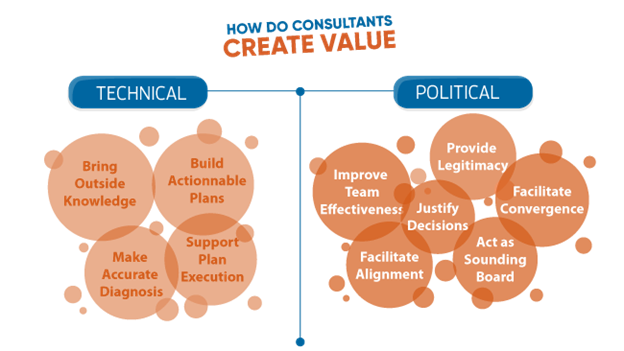

Let’s look at the value generated by consulting instead of looking at these Consulting Firms. We can see patterns and, in particular, identify two dimensions: technical and political, using the value prism. Most consulting projects create value along these two axes.

- Technical Value

The technical value is demonstrated through in-depth understanding. Whether the consultants have outside knowledge, help diagnose a problem and its solution, or assist in implementing the said solutions, most operational projects fit into this category.

- Political Value

The political value is more difficult to grasp. Anyone who has spent time in the business world understands the importance of corporate politics. In times of trouble, CEOs may seek support for their decisions, enforce unpopular changes, or become the fall guy. It can also be used to assist in the formation of consensus among stakeholders or function as a sounding board.

How measure that value?

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half.” John Wanamaker

It’s also the case with consulting. We may not always be able to quantify the impact. However, all projects (should) provide value to your organization. How, then, do you quantify this value?

You can’t use a tape measure to verify if the project outcomes are within tolerance ranges because services like consulting are intangible.

The technical value is typically easier to quantify since it usually delivers concrete benefits such as cost savings or revenue increases. The political value, on the other hand, is more difficult to assess.

How would you recognize the value generated by a cultural and diversity project or process and system optimization? Other functions have been successful in quantifying intangible things like client satisfaction or employee engagement.

There is no standard for the value generated through consulting. It sounds hilarious when you consider that the Consulting Industry was created to answer the companies’ need to measure the performance…

Where did Consulting come from?

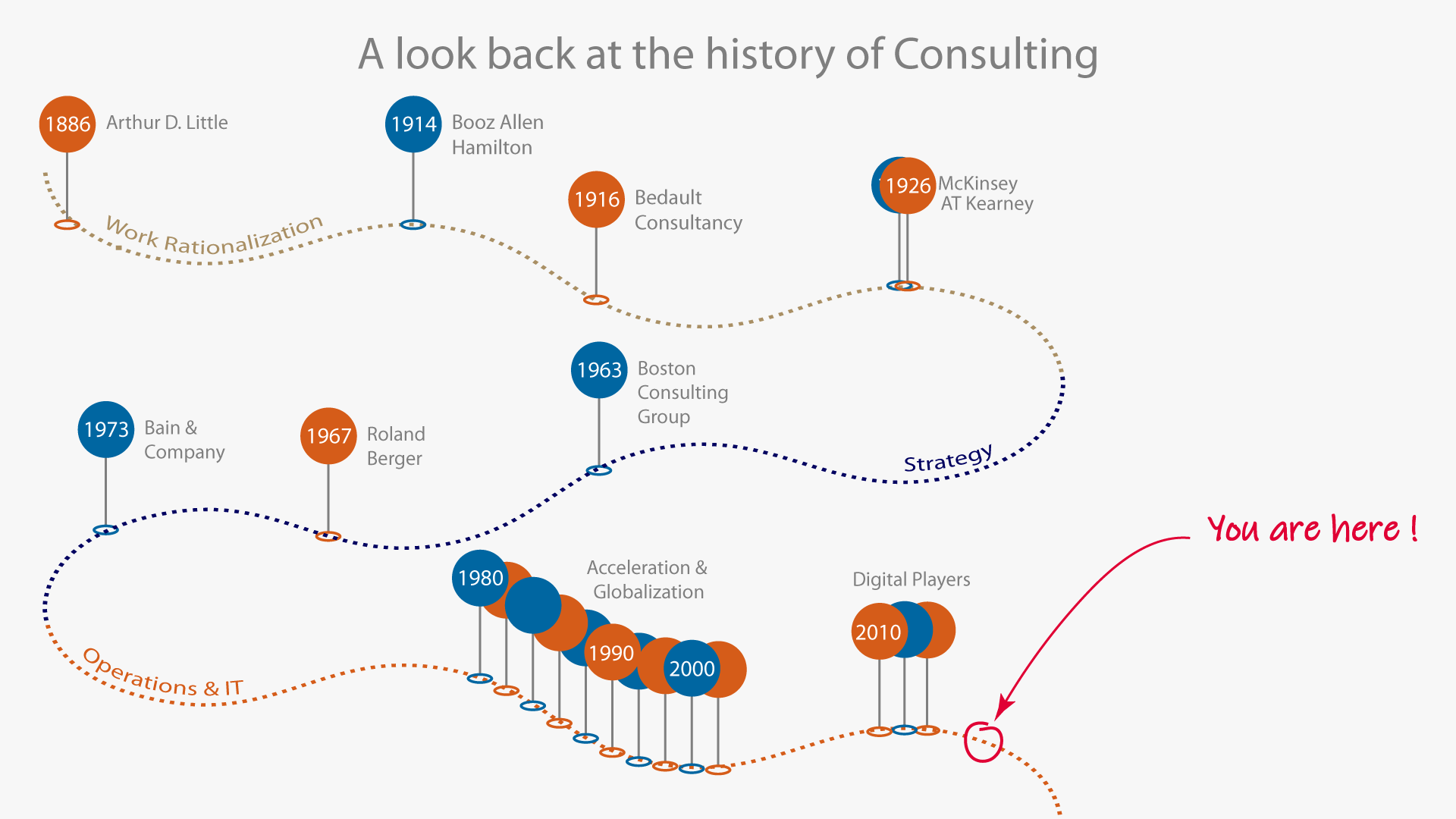

Consultation has long been a part of life. We can follow advisors back to ancient times, with Marco Polo, Colbert, and Hamilton as notable examples.

At the end of the nineteenth century, modern consulting began during the second industrial revolution in Europe. Operations efficiency was required as a result of the significant adjustments and fast development of factories.

After the 1929 Market Collapse, the focus of Consulting moved to Strategy, with the creation of today’s strategy giants such as McKinsey, BCG, and subsequently Bain. Simultaneously, the Big 4 Accounting Firms ramped up their involvement in consulting by leveraging their connections with C-level executives.

In the 80s and 90s, there was a continued increase in demand for organization and Strategy. In addition, the invention of the computer and network technologies opened the door to a new consulting area: IT. Simultaneously, the ENRON scandal drove the Big 4 away, forcing them to split their accounting and consultancy operations.

At the same time, McKinsey introduced the idea of Business Excellence, followed by many other consultancies that adapted it to all aspects of a company’s operations: R&D, Sales, Marketing, and so on. The addition of numerous new competitors sparked the division and specialization of the market in various capabilities first before moving on to industries served.

The consulting business has long followed technological and management trends. The advent of the digital wave is bucking this norm. Digital integration has been introduced by consulting firms. As a result, Strategy Titans have begun stealing digital transformation projects from the IT Giants, while IT Titans are attacking strategy projects through the digital lens.

The diversification and segmentation of the Consulting Business have fragmented the market. Depending on the maturity of both customer and provider of consulting services, each region develops at its own rate.

What are the distinctions between regions?

North America, not Europe, was the birthplace of management consulting. You won’t be surprised to learn that North America is the world’s largest market for consulting services and accounts for almost half of global sales. The United States has by far the most significant number of consultants and consultancy organizations. It also generates a more significant amount of income than all European nations..

Both North America and Europe have established markets where the usage of Consultant Services is no longer a novelty. As a result, they concentrate on digitization, innovation, marketing and sales, technology, and operational improvements.

Europe is a varied market, with one side representing mature markets in Western Europe with moderate growth. In contrast, Eastern Europe has less developed countries experiencing rapid expansion on a much smaller scale.

Asia, the Middle East, and Africa are all developing at a much quicker pace than mature regions. Asia-Pacific is the fastest-growing market with lots of promising prospects for Western consulting firms in Japan and Oceania and several fast-growing emerging markets.

With the severe challenges that have affected all nations and enterprises, Latam is still in rehabilitation mode. And Brazil is, without a doubt, the most important market with over a thousand different service providers.

Most of the major Consulting Firms have put down roots in developing countries, establishing generalist offices. On the other hand, local firms continue to make up a significant portion of the providers (according to Consource, 71% of providers are only based in one region). With the industry’s segmentation and typification, there is an infinite variety among Consulting.

The different typologies of Consulting Firms

Have you ever found yourself browsing for a consultant website and wondering: “what do they concretely do? What problems do they solve? And what are they actually good at?” The good news, if we can refer to it this way, is that you are not alone.

For companies helping others define their value proposition, sharpen their Strategy, and optimize their marketing budgets, many consulting firms are pretty slow to embrace the internet and even more social media. So to facilitate your future browsing, we have tried in this chapter to give you an overview of the critical dimensions that characterize the DNA of a consulting firm.

Capabilities

The Capabilities are the Services offered by consultants to mirror the business functions that client organizations need to perform. This dimension is crucial to describe the work in consulting.

Having screened thousands of consulting websites when creating Conavigo.com we have seen websites ranging from professional to awkward. Nevertheless, we can confirm that most Consulting Firms will showcase this dimension on their website and company presentations.

A little bit like a process map, you can organize the Capabilities in 7 High-Level Categories. Then, the market size corresponding to those capabilities is linked to the difference in size and budgets of the associated client functions and potential value.

In the absence of a standardized breakdown, we are using our own classification.

Strategy & Management

Strategy is about building a competitive advantage among the competition and making profits. As a result, the capability is geared toward high-level corporate decisions. It helps leaders define “where to play” and “how to win.” A significant share of high-level Consulting engagements falls in this category.

For a long time, Strategy was the dominant capability. However, its relative share in the overall consulting market has decreased while implementation and excellence projects were flourishing. Today this category represents about 10% of the global market.

This category includes Corporate Strategy, Business Unit Strategy, Organization Architecture, Management Model, Corporate Governance, Innovation Strategy, M&A, Strategic Communication, and Economic or Government Policy.

Sample projects include :

- Crafting a 5-year strategic roadmap to go from a commodity to a specialty player in Chemicals

- Designing and implementing a customer-centric organization in Consumer Goods

- Using Game theory to anticipate moves from Competitors and take strategic decisions

- Performing an M&A screening to build a pipeline supporting strategic priorities in financial services

Sales & Marketing

Sales & Marketing is focused on top-line activities to help companies drive profitable growth. Sales & marketing consultants support clients to deliver above-market growth by developing their marketing capabilities or improving their sales effectiveness. This capability is striving in the consulting market as its impact on P&L is usually direct and measurable. The category represents close to 10% of the management consulting market.

This category includes Branding, Revenue Management, Market Entry Strategy, Omni Channel Marketing, Sales Effectiveness, or Customer Experience.

Sample projects include :

- Optimizing Yield / Revenue Management for an Airline using data analytics and customer behaviors

- Improving in-branch customer experience for clients in a traditional bank

- Optimizing the organization, territories, and activities for the commercial teams after a merger of pharmaceutical companies

- Implementing Machine Learning to optimize Marketing investments in consumer packaged goods

Operations

Operations are one of the largest lines of services. It regroups most of the activities where products and services are usually built or delivered. Even though Operations can be a source of innovation and a differentiator, most of the time the focus is on reducing costs and increasing throughput. Operations consultants use concepts such as Lean, Six Sigma, or Quality Management to help their clients streamline and improve operational efficiency. It represents about 25% of the market for management consulting.

The category includes capabilities such as Manufacturing, Procurement, Supply chain, Quality Management, and Compliance, G&A Optimization, Lean or Knowledge Management.

Sample projects include :

- Defining a make-or-buy strategy for parts of the activities for an OEM

- Designing and implementing a blueprint for manufacturing activities for a Flat Carbon Producer

- Leveraging Blockchain to optimize the supply chain of an automotive company

- Using Lean to optimize back-office activities in the private loans department

Finance & Risk

Consulting firms specialized in financial advisory services work with finance and risk management executives (such as CFO’s). They help them make decisions, develop customized strategies, and deliver superior results by analyzing their companies’ financial and economic risks and uncertainties.

The category represents close to 20% of the management consulting industry. Its size is often difficult to assess given the overlap of the activities with legal firms, auditors, and M&A boutiques.

The category includes capabilities such as Corporate Finance, Actuarial, Restructuring and Crisis Management, Tax Advisory, or Risk Management.

Sample projects include :

- Leveraging Supply Chain Financing to optimize cash management between Customers and Suppliers

- Analyzing potential impacts and defining optimum strategies to face significant changes in Tax Policies (Brexit, Trade-War, …)

- Implementing new Risk Management regulations and associated governance in Financial Services (BASEL III, …)

- Turnaround management for companies close to Bankruptcy

Human Capital

Human Capital consulting focuses on maximizing the value created by Human Resources, or employees, in an organization. The offering is quite wide from Organization and Leadership Development to Improving the Effectiveness of the HR function.

Since the capability has low barriers to entry and many consultants set up their own business, as a result, the market is highly fragmented. Besides, there is a low level of market share concentration despite the significant number of operators. The top four companies in the industry generate just over 20.0% of the industry’s revenue. The category represents about 10% of the overall consulting market.

The category includes Talent Management, Organization Development, HR Effectiveness, Social Relations, or Compensations & Benefits.

Sample projects include :

- Building an efficient strategy, embraced by the management to boost Employee Engagement in a Transportation Company

- Leveraging advanced workforce planning analytics to map career flows and anticipate future needs and shortages in Aerospace Engineering

- Designing a robust succession planning for the key executives of the company in a High Tech Startup

- Implementing Digital Tools and driving the associated change management to optimize HR processes

Research and Development

Research & Development Consulting is helping companies to optimize the way they are developing Products and Services. Companies aim to find the right balance between a strong focus on customer needs and delivering cost-effective returns. In a time of constant change and when innovation cycles are accelerating, the research and development activities have become a key differentiator.

The consulting offering ranges from identifying where technologies and skills will be required to how products and services are developed. With about 5%, it represents a small but very valuable portion of the consulting market.

The category includes R&D Strategy, R&D Effectiveness, Product Development, Manufacturing Engineering, Open Innovation :

Sample projects include :

- Globalizing R&D and Optimizing the footprint for a global food ingredients company

- Defining and Implementing an effective Innovation Portfolio Management in Mining

- Leveraging concurrent engineering to accelerate product development in Aerospace

- Implementing an Innovation System to spur Innovation for an Insurance Company

Technology & Digital

Technology Consulting might also be referred to as IT consulting. However, the rise of Digital, Fintech, and all the Tech Startups activities is changing the rules of the game. The capability has been rejuvenated as most companies have now elevated technology to the highest level of their agenda.

Technology consultants offer services helping companies embrace new technologies, digitize their processes, and modernize their legacy systems. In short, leverage technology as a source of competitive advantage. The scope for this activity overlaps with Strategy and functional areas for Strategy, media, and specific systems and with IT services for the low-end/recurring activities. Depending on definitions the category can represent up to one-third of the global consulting market.

The category includes Digital Strategy, Digital Architecture, Systems Integration (CRM, ERP, …), Data Management and Analytics, Cyber Security, or IT related services.

Sample projects include :

- Helping Retailers to make buy vs. build decisions when deciding on their new IT Platforms

- Leveraging Machine learning to understand customer behaviors better and reduce churn in telecommunications

- Assessing the enterprise cybersecurity architecture and technical controls in Payments

- Implementing digital studios worldwide to spur the use of digital and embed a digital culture in Energy

Others

All the previous capabilities can usually be mapped to functions within a given corporation. However, several capabilities are more difficult to link to an existing function since they can have either cross-functional or company-wide impacts. Those services can be offered either by large consultancies or by very focused ones.

The other category includes Disruptive Innovation, Branding, Post Merger Integration, Sustainability, and Corporate Responsibility or Value Transformation.

Sample projects include :

- Conceiving and Scaling Disruptive Businesses in Chemicals Distribution

- Aligning the top management and mobilizing the organization to embed Sustainability in the organization in the Energy sector

- Preparing and Facilitating Post Merger Integration using clean teams in Banking

- Assisting a new CEO and his board in designing the vision and planning the Transformation of the Company in Pharmaceuticals

Industries Served:

The industries served are the sectors in which clients of consultants operate or the sectors they are looking at. Generally, demand increases with the amount of change in a given sector and the ability to invest in the industry.

The 5 Industries with the highest demand for consulting services are the Financial Services, Health & Life Science, Manufacturing, Public Sector, and Energy

Financial Services

The Financial Services Industry is historically one of the largest users of Management Consulting. From Banking to Insurance or Wealth Management, the industry is facing unprecedented challenges from both traditional and tech players. New technology is enabling new business models and rendering old platforms obsolete. Besides, most companies are shifting from a product to a customer-centric model. With so many options in front of them, companies need to select carefully where they invest their resources to achieve their growth ambitions.

Sample projects include :

- Designing a new incentive scheme for the commercial branch to drive customer and value-oriented behaviors in Retail Banking

- Building a roadmap to modernize the business model from implementing self-service to sharing capabilities across businesses and digitizing processes to spur efficiency in Capital Markets

- Benchmarking the IT performance and investments priorities amongst Asian-based Insurers

- Reviewing the Risk Function Operating Model to increase agility in Banking

Public Sector

The Public Sector, namely government and administrations, is a very large segment of the consulting industry. The types of consulting projects can vary greatly depending on the level of development of the countries. Governments in all economies are asking for help to drive national investment strategies or fiscal policies favoring economic development. They also need support to analyze and anticipate complex situations like Brexit.

Many developing economies need support to manage large infrastructure projects. Western economies leverage consultants to drive the simplification and productivity initiatives in public services. In recent years, the pressure is mounting on Governments the reduce the cost of consulting engagements. Even the IMF recently recommended for developing economies to reduce the utilization of Blue Chip consultancies.

Sample projects include :

- Providing government with actionable advice to support the government in accelerating economic development

- Redesigning the end to end logistics process for a ministry of defense

- Developing policies and strategies to support Fintech and financial inclusiveness for Asian Governments

- Support public bodies (government, commissions, associations, … ) with expert analysis in case of potential Antitrust situations

Health & Life Sciences

Health and Life Sciences in its largest definition represents 5% of the consulting industry demand. This significant share is indeed no surprise when looking a little bit closer. It includes Pharmaceuticals, Medical Technology, Healthcare payers, and delivery systems. Healthcare costs are exponentially growing in many countries. In the US they are close to 20% of GDP.

Healthcare Payers are under pressure to reduce costs while providers need to increase their efficiency. Pharmaceutical companies have to navigate vast R&D portfolios as shareholders expect significant returns. Besides they have to deal with a complex ecosystem with a challenging tryptic user (patient), prescriber (physician), and a third party (payer).

Sample projects include :

- Developing strategies to accelerate the shift from Volume to Value in Healthcare

- Creating an M&A Pipeline to refresh and dynamize innovation in Pharmaceuticals

- Building actuarial models to optimize growth vs. profitability for Healthcare Payors

- Transforming a national healthcare system to ensure better coverage of citizens

Manufacturing

The manufacturing segment also takes a significant share of consulting investments. Manufacturing, however, is made of several distinct industries, rarely mentioned as such. We grouped industries with similar contexts and priorities. Our definition of Manufacturing includes Automotive, Aerospace, Consumer packaged goods, Electronics, and Process industries.

All those industries are facing growing headwinds, competitiveness challenges, and an aging workforce. They are also challenged to embrace new technologies that can completely disrupt their value chains.

Besides at the same time as the planet goes global, we observe regional customization and even personalization of products and services. This phenomenon leads to an acceleration of innovation cycles and a growing complexity to manage. Last but not least the wages gap between Western and Eastern economies has reduced with more possibilities for automation at an affordable cost. Most companies are rethinking their global footprint and supply chain to adapt to tomorrow’s challenges.

Sample projects include :

- Scanning the Manufacturing Start-up ecosystem to identify the right partners to reduce maintenance costs

- Implementing a new procurement framework and systems to operate seamlessly with strategic suppliers

- Embarking all manufacturing plants in a transformation mixing lean and digital for a motorbike company

- Leveraging Concurrent Engineering and Spiral Development to reduce costs and shorten development times with late customization in Aerospace

Energy & Environment

The energy and environment segment is closely linked to the public interest. It includes oil and gas, energy, utilities, renewable energy. Companies in Energy and Utilities are facing increasing customer demand, high capital investment, increased competition, and more stringent regulations. While companies in Oil and Gas continue to cope with the new normal with lower prices, higher volatility, and shorter cycles.

Most companies focus their efforts on maximizing the short-term returns of their investments, improving resource productivity, and lowering total operating costs. An interesting trend is the growing utilization of data analytics in support of operations to leverage the massive amount of data available.

Sample projects include :

- Leveraging IoT to increase network reliability thanks to predictive maintenance

- Mapping the value pools post-crisis in Unconventional Oil & Gas

- Redesigning commodity trading systems to speed up decision making while managing risks

- Using big data analytical techniques to maximize returns in Energy Retail

Various degrees of specialization

But there are other dimensions to consider when looking at consulting firms. The management consulting industry is made of various degrees of specialization.

The Industry Specialization dilemma

As you probably know by now, the consulting industry started with a specific focus on manufacturing optimization, then encountered a period of growth in strategy work. The capability dimension was the driver, and the industry served as a secondary dimension. Several consulting gurus such as Bill Bain or Dominique Mars even pushed the theory that serving only one client per industry was the best way to avoid conflicts of interest.

However, companies are getting more and more specialized. And the industry specialization is becoming a must for a lot of clients and a commercial and productivity lever for many companies. To date, we can observe three kinds of positioning for consulting firms.

Generalist Consulting Firms offer a vast scope of consulting services. They usually cover most of the matrix Industry vs. Capabilities. Oliver Wyman is a generalist consulting working with almost all industries on topics such as Strategy, Sales & Marketing, Operations, Organization, or Finance. Human Capital Consulting is provided by its sister company in the MMC Group: Mercer HR.

Specialist Consulting Firms are focused on a narrow scope of consulting services. They concentrate efforts and abilities in a specific capability or a particular industry. Camelot Management Consultants, for instance, is a specialized consulting firm focused on only four industries: Chemicals, Life Sciences, Consumer Packaged Goods, and Industrial Manufacturing.

Niche players are Consulting Firms that offer a specific service in a particular industry. They are the intersection point in a matrix of services and sectors. Contax Partners is a Niche Consultancy focused on Strategy in the Energy Vertical in the Middle East and Africa. ZS Associate was for a long time focused exclusively on Sales and Marketing in Pharma before branching out in other industries.

Generalists

They have the ability to provide their clients with a broad-based understanding that can readily change according to their demands. They will also notice economies of scale and scope. They frequently have knowledge in several businesses and skills, allowing them to be adaptable. However, it sometimes comes with a superficial knowledge of a given industry or function

Furthermore, it’s not uncommon at the most junior levels within large Consulting Firms to work successively on a strategy project in Financial Services and on an operations project in Manufacturing.

Specialists

They achieve greater levels of expertise and knowledge than generalist consultants. They stay on top of new discoveries and industry news, as well as the competitive pressures in their field.

They may, however, be narrow-minded because they only focus on the problems in their own field of expertise. Besides, when dealing with experts from the business sector, Chinese walls to guarantee data privacy are more difficult to maintain.

Niche Player

The advantages of this type of consultancy are clear: Its members have a unique viewpoint and approach, which they can use to their advantage. They know their sector better than generalist consultants who work in several industries, and specialist consultants who offer one service in various sectors.

But they don’t perform well with projects that span industry or capability lines. They view everything through the lens of their specialty, and they may not come up with out-of-the-box thinking because of this focus.

Hybrid vs. Pure consulting players

Pure Players are companies that only provide Consulting Services. Most major consulting firms such as McKinsey, BCG, Bain & Company, and Oliver Wyman, can be considered are pure players.

Hybrid companies offer consulting services on top of their primary business. They can be providing services in Audit, Legal, Accounting, or Systems. Famous Hybrid Companies are Deloitte (Audit and Tax), EY (Audit and Tax), PWC (Audit and Tax), Accenture (Systems), and Huron Consulting (Systems).

Pure Players

They are specialized Consultants that master project management, deliverables, and problem-solving skills. They might have some difficulties grasping the complexity of your company beyond their scope of expertise.

Hybrids

Business and IT services firms, typically known as BPOs (Business Process Outsourcing), implement solutions that are tailored to the customer’s needs. They provide comprehensive services from consulting to implementation.

They may be less expensive than comparable-sized pure players. They use their strong ties to cross-sell other products and services. They are sometimes pushing services where they are not the greatest option. There may be some situations in which there is a conflict of interest.

Digital is now rising and becoming a must of any company strategy. Most consulting firms are either embedding digital capabilities or developing digital ecosystems. Accenture is particularly active on this front. In the same way, former pure IT players are now acquiring consulting firms as a way to spur their IT activities.

In the 90’s EDS had pioneered this move in acquiring AT Kearney. But the partnership never really delivered, and ATK leaders struck a management buy-out 10 years later. In recent years, a good example would be the series of acquisitions performed by IBM. Or the acquisition of Innosight by Huron.

Other dimensions

Beyond the expertise area of a company, other factors will help you to understand what you can expect from a given company.

Size & Geographic Footprint

A lot of businesses have a similar size and shape. People still sell to people in the consulting industry, so if you want to expand, you’ll need to scale up and establish offices in new areas.

Only the largest consulting firms and IT companies have offices across the world today. It’s uncommon to find a presence in more than 3 countries whenever you’re dealing with businesses with less than 100 employees.

Like in other industries, the footprint of a company is important. For Consulting Services, it can impact the ability to understand local ways of doing business. Besides the original location of your consulting team weights heavily on the travel expenses budget. Imagine a team commuting to Singapore from Germany for 6 months.

Global

They know how to operate in an international setting and can serve their clients from several nations. Projects that need an on-the-ground presence all over the world are particularly fascinating.

They frequently collaborate with regional P&Ls, which means they may instead seek to improve their regional utilization rate rather than bringing the finest global team in front of the client. Global presence, brand, and scale usually come at a cost.

Local

You’ll have the partners you need in whatever location you need them. For local projects, it may be exactly what you require from a cultural standpoint.

When they are traveling, you will have to pay for any travel costs. They might find themselves without many clues about how to fit in with the local culture when working abroad.

Ownership Structure

A Majority of Consulting Firms are structured as partnerships, like law firms. The organization structure is based on a small group of equity partners, often “rain-makers,” that bring in the clients and the projects.

The traditional career path is to climb the internal ladder before making it to partner after usually 10 to 15 years. You will find in this category blue-chip players like McKinsey or BCG as well as most boutique consultancies.

However, as they grow (and often get acquired), more and more consulting firms go public, are owned by larger traditional companies or by other service companies developing a consulting branch.

Being a Partner in this case mostly describes the role and seniority of individuals. They steer business activities but have little say on the direction of the company and own a limited amount of shares of the mother company. The management of the company is usually quite similar to partnerships.

However, the pressure on results and revenues expectations are different. You will find in this category companies like Accenture, Oliver Wyman (owned by Marsh McLennan), FTI Consulting, Huron Consulting.

You can observe the same phenomenon with the big 4 audit companies as they are acquiring medium-sized consulting firms at full speed to regrow their consulting arms. Once acquired those companies sometimes keep their initial brand but the context they operate in is very different.

Partnership

The consultants are personally invested in the firm’s brand and reputation since they own it. They have a vested interest. In medium-size consulting firms, partners tend to “own” their clients. It might be challenging to find the finest partner for your project as a result.

Traditional Organization

The presence of shareholders puts a strong emphasis on earnings, but it can also provide resources for faster development, acquisition of skills, and investment in innovation. Both risks and benefits are reduced; the most talented consultants prefer the partnership model.

Profile of Partners

With today’s technology, you can now access rather easily the online information of almost any consulting partner. You will usually have access to their profile both on the company website and on LinkedIn. Also, if you ask for a proposal, you will probably have included another of their resume highlighting the relevant experience.

Browsing partners’ profiles will help you to identify if the company is very diverse, entrepreneurial, very technical, or an army of clones. It will also help you to quickly spot if the consulting firm is claiming an experience without having too much to show for it. For instance, it would make sense for someone claiming expertise in a given capability to have written at least a few papers on the subject.

Last, with boutique firms, you will see that the background of the founders is an interesting source of information. Do they have an operational profile and converted late to consulting? Is the company a spin-off of a large consulting structure? You can often find in boutique firm consultants with the experience and quality standards of large companies. But you will get them for a much lower cost since they don’t have the associated overheads and luxury offices.

Delivery Model

Now you know what the capabilities and industries where a consulting firm claims to have expertise are. You also understand what the background of the partners is and where they are located on the globe. You, therefore, start to have a pretty clear idea of “what” they could do for you or at least on “what topics” they could have an added value.

However, there are still numerous dimensions to be recognized and evaluated, which will separate consulting firms. Depending on your situation and culture, these characteristics could be a make-or-break factor in your selection. The “how” of consulting work is addressed by the following dimensions.

There must be a suitable match between what you want to accomplish and how consultants typically operate. Some consulting firms may be better suited for diagnosing a problem or developing a strategy, while others will be more effective in the implementation.

Some consulting gurus are great at describing to their clients why their company is broken. When you ask them for ideas on how to address it, things become a lot more difficult.

In the same manner, some highly operational consultants would be a great fit to lead teams through a shopfloor transformation. However, they may not have the right profile to communicate in board language.

The first category mentioned above is called “Study and Recommend,” and the second one is “Teach and Facilitate.” Usually, consulting firms that excel at one, tend to have more difficulties on the other.

“Study and Recommend” can be performed remotely with a limited number of interactions with the organization. “Teach and Facilitate” on the other hand requires a presence on the ground. Last, the fees tend to be quite different as well. Identifying what direction to take tends to be valued at a much higher price point than the implementation part.

Another way of looking at delivery models is linked to the key success factors for a given project. Those key success factors can be tied to either hard or soft elements. To roll out your newly developed Strategy and create buy-in you may want to use consultants with a high sensibility to soft elements. On the contrary, to develop this Strategy in a fact-based manner you may want to use consultants more focused on the hard elements. It is usually difficult to find consultants able to operate on both dimensions.

Finally, to have an impact and transfer knowledge to your teams you might need to pay specific attention to the seniority of the consulting teams. Large consultancies have implemented for years a pyramidal model. It gives them access to very qualified and highly motivated young talents, able to burn the midnight oil for several weeks in a row. If they do well, they can climb the consulting ladder very quickly. If they don’t perform, they leave the company.

That model reaches its limits when these young talents directly interface with operational teams twice their age. We observe today the seniorizing of the profession. Companies are moving away from the pure pyramidal model and cultivating consultants focused on the production and not aspiring to become senior partners. Is it the model of the future? The solution is probably a combination of both models depending on the project’s nature.

What is Internal Consulting?

At a time when most large companies have now a corporate venturing entity, another trend has started to emerge in most Companies: internal consulting. While most Western companies are regularly using Consulting, the hefty prices combined with the need for specialized resources have prompted some clients to explore new options to fulfill their needs.

Consulting Expenses have also skyrocketed in the last 20 years. On one hand, Companies are buying way more than before, on the other one the major players have steeply increased their fees per consultant. With the pressure on OPEX, executives have to find other ways to get the support of consultants at a lower cost.

Working with consultants used to be a guarantee that you would discover new approaches. However, today, because part of the management theories and tools have been commoditized, organizations may more easily access knowledge and reduce the demand for external consultants.

In addition, Internal Consultants may leverage knowledge and experience more quickly than large generalist consulting firms since they work with just one client in a single sector. They also make up for their lack of external comparison by having a deeper connection with the firm, its business, and its culture.

Finally, many businesses have come to recognize the importance of confidentiality. Many external consultants have established a business by collecting information on their customers and then providing it to their competitors. Working with internal teams may be the finest method to keep secrets at home in some projects.

Closing Thoughts

We just went through some of the most important aspects that define today’s Consulting sector. Increasing your understanding of the market is always a good thing to do. And learning about it is as simple as Procurement 101. You may now construct a fairly accurate profile of any consulting firm after collecting this information.

- Where is their area of expertise (Capabilities & Industries)?

- What is the background and profile of the partners?

- What are the size and geographic presence of the company over the globe?

- What is the delivery model of the company?

- What is the evidence supporting those claims?

We hope you have enjoyed this guide and feel more familiar with the management consulting industry now. Ready to source a project? Read our comprehensive guide and learn how to buy a project like a pro.