Table of Contents

In the ever-evolving landscape of the consulting industry, the sage words of Warren Buffett act as both a warning and a guiding principle: “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” As we explore conflicts of interest in consulting, Buffett’s wisdom sets the stage by reflecting on the delicate balance between reputation, ethical conduct, and the enduring trust that underpins the consultancy-client relationship.

Join us as we delve into historical scandals, current issues, and ethical challenges faced by consulting firms, probing for the solutions within the regulatory frameworks and industry practices.

1. Chronicling the Issue: Conflicts of Interest Through the Years

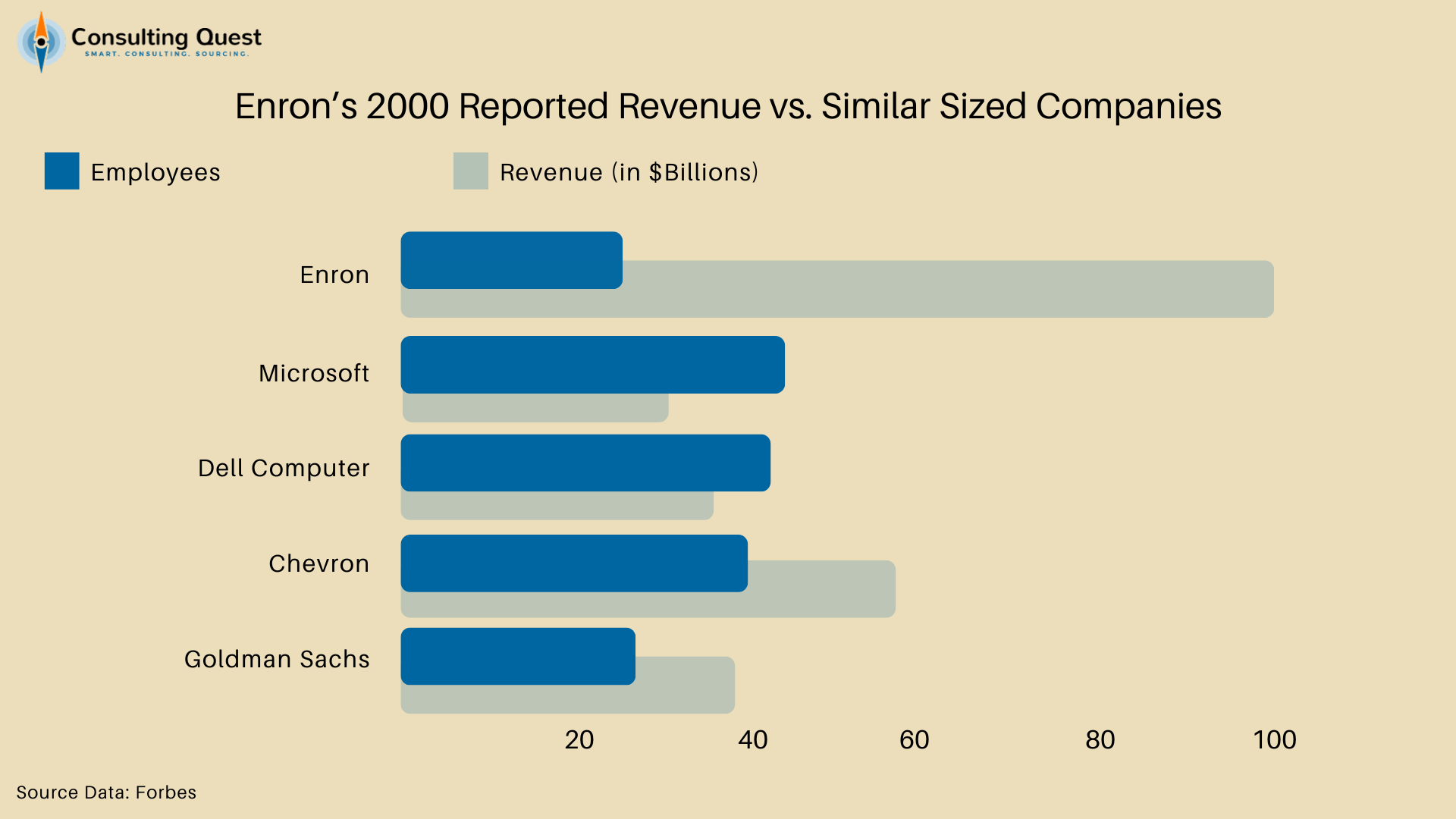

In recent years, the consulting industry has been rocked by a series of scandals, bringing to light serious concerns about conflicts of interest within its major players. These incidents, reminiscent of the infamous Enron scandal, raise questions about the ethical compass guiding these consultancy giants and the effectiveness of regulatory measures put in place to prevent such conflicts.

1.1 Enron as a Case Study: A Reflection of Larger Issues

Two decades ago, the Enron scandal unveiled a disturbing web of deceit, fraud, and gross mismanagement, shaking the core of corporate America. At the heart of the crisis was a profound conflict of interest: Arthur Andersen, not only the auditor for Enron but also a consultant, failing to maintain objectivity and independence. The fallout was catastrophic, leading to the bankruptcy of Enron and the dissolution of Arthur Andersen.

This debacle prompted sweeping changes in corporate governance, particularly with the enactment of the Sarbanes-Oxley Act of 2002. This act aimed to disentangle the intertwined roles of auditing and consulting within the same firm, setting a precedent for stricter regulatory oversight in the corporate world.

1.2 Current Allegations Against Top Consulting Firms

Today, echoes of Enron resound in the allegations facing leading consulting firms. McKinsey & Company, for instance, stands accused of prioritizing its lucrative oil and gas clients’ interests over pressing global climate goals during the UN’s COP28 climate talks. This dual role of climate advisor and consultant to major fossil fuel players sparks a serious debate on the integrity of their advice.

Similarly, PwC has found itself embroiled in a series of global controversies. Most notably, their Cyprus affiliate’s involvement in managing the wealth of figures close to Russian President Vladimir Putin, and the leaking of Australian government tax plans, have raised eyebrows about the firm’s commitment to ethical standards and fair practices.

The Boston Consulting Group (BCG) has not been spared either. Allegations of manipulating procurement processes for financial gain, evidenced in email exchanges, have tainted their reputation, raising concerns about their ethical conduct in government contracts.

KPMG’s situation is no less concerning. Accused of overcharging and billing for unreal work on government contracts, and particularly in their involvement with the Australian Signals Directorate’s REDSPICE project, KPMG’s actions have been scrutinized for potential unfair advantages and conflicts of interest.

These cases underscore a recurring theme of potential conflicts of interest, where the advice or actions of these firms appear compromised by their relationships with clients or government bodies.

1.3 Lessons Learned and Paths Forward

This resurgence of scandalous behavior in the consulting industry comes at a time when regulatory constraints, established post-Enron, are being reconsidered. The question arises: Is this rollback a misstep? The similarities between these recent cases and the Enron situation are striking and worrisome. There’s a palpable fear that loosening these regulations might lead to a repetition of past mistakes, undermining the industry’s credibility and the trust of its clients.

The heart of consultancy lies in the trust clients place in firms to provide unbiased, objective advice. Conflicts of interest, whether perceived or real, can significantly damage this delicate relationship. They risk leading to suboptimal solutions that do not fully cater to the unique challenges and goals of the client, potentially compromising the public’s interest in government-related projects.

In consulting, where ethical boundaries are continuously tested, the importance of vigilance and strict adherence to ethical standards cannot be overstated. The lessons from the Enron scandal remain as relevant today as they were two decades ago, underscoring the need for robust regulatory frameworks and a steadfast commitment to ethical practices in the consulting industry.

2. An Ethical Conundrum That Goes Beyond Large Consulting Firms

The post-1990s era has heralded a trend towards specialization and segmentation in the consulting industry. This evolution, while enriching the depth of expertise, has given rise to complex ethical dilemmas. Consultants, especially those with deep industry experience, frequently confront potential conflicts of interest, particularly when serving direct competitors.

2.1 Transformative Shifts in Consulting Practices

In the 1990s, the consulting industry underwent a significant transformation with the emergence of boutique consulting firms. These firms began capitalizing on their deep expertise in either specific capabilities or industry experience, growing predominantly in one dimension. This approach offered a unique value proposition compared to generalist firms: a depth of expertise that catered to more specialized needs.

This trend led to the development of three distinct levels of specialization within the consulting landscape:

Generalist Firms: These firms, like McKinsey, offer a broad range of services across various capabilities and industries. They are characterized by their wide scope and ability to address a diverse array of client needs.

Specialist Firms: Firms such as Renoir Consulting fall into this category. They provide services to a select few industries, focusing on a limited set of capabilities. Their expertise is deeper than generalist firms but broader than niche players, striking a balance between specialization and versatility.

Niche Players: The Pangeae Group exemplifies this type of firm, focusing on either one specific capability or serving a single industry. Niche players offer deep, concentrated expertise in their chosen area, providing highly specialized solutions that are tailored to very specific client requirements.

The shift towards these varied levels of specialization was driven by client demands for more targeted, industry-specific knowledge and expertise. This evolution not only diversified the types of consulting services available but also introduced new dynamics and challenges, particularly regarding conflicts of interest in an industry increasingly focused on specialized knowledge.

This move, although advantageous for gaining industry-specific insights, has introduced a moral quandary. Consultants juggling projects for competing clients face a dilemma: risk violating the confidentiality of a former client or compromise the level of expertise offered to the current one. This issue, deeply rooted in the business models of consulting firms, extends beyond individual ethical decisions, indicating a systemic challenge within the industry.

The ethical complexities are compounded when considering consulting firms that provide regulatory advice to public administrations, only to help private companies navigate around these same regulations. This dual role raises questions about the firms’ ethical foundations and their commitment to impartial and transparent advisory services.

2.2 The Misconception About Firm Size and Ethical Practices

There is a common misconception that large consulting firms are uniquely prone to conflicts of interest. However, this issue is structurally embedded in the consulting industry at large and is not confined to big names. As clients increasingly seek out specific expertise and industry experience, the potential for conflicts of interest grows, affecting firms of all sizes.

Smaller consulting firms, often perceived as less exposed to such conflicts, face their own challenges. Technically, their high degree of specialization and smaller client base might even intensify these issues. The nature of their work often requires a deep dive into niche areas, which can lead to scenarios where even a limited number of clients can create significant conflicts.

In reality, the scale of the firm does not inherently mitigate the risk of conflicts of interest. Instead, it’s the industry’s overarching emphasis on specialization and expertise that intensifies these challenges. The increasing client demand for industry-specific knowledge, while justified, only amplifies the potential for conflicts, making this an industry-wide concern that transcends firm size.

3. The Client’s Dilemma: Navigating the Trade-Offs in Consulting Engagements

In their pursuit of cutting-edge solutions and industry benchmarks, clients engaging with consulting firms often face a significant dilemma. Seeking expertise and proven track records inadvertently involves the exchange and potential sharing of proprietary strategies and methodologies. It’s crucial for clients to recognize that their unique differentiators today might become the industry standard tomorrow in this shared knowledge ecosystem.

3.1 Information in Consulting: A Give-and-Take Issue

The consulting industry operates on a dynamic of give-and-take. When clients seek insights and best practices, they are, in effect, contributing to a collective pool of knowledge. This aggregation, though anonymized, often includes unique strategies and methodologies from various clients. The challenge lies in maintaining a balance between sharing valuable information and protecting proprietary breakthroughs that could inadvertently benefit a competitor.

While hiring consultants with deep industry experience offers considerable advantages, it also presents a trade-off. In areas critical for maintaining a competitive edge, like strategy or innovation, sharing best practices can inadvertently erode a firm’s unique advantages. Clients must carefully consider the immediate benefits of consultancy against the potential long-term implications of shared competitive intelligence.

3.2 Different Projects, Different Approaches

The risk associated with sharing knowledge in consulting varies significantly depending on the nature of the project. Operational projects, such as improving factory productivity or management efficiency, typically benefit from shared best practices with minimal risk to competitive advantage. In contrast, strategy and innovation projects demand a more cautious approach due to the higher stakes involved in maintaining uniqueness.

Projects like competitive production cost analysis exemplify the fine line between collaboration and the risk of losing a competitive edge. Both clients and consultants need to navigate these scenarios with a strong ethical compass and a clear understanding of the strategic implications of information sharing.

3.3 Assessing the Benefit-Risk Ratio to Make Informed Decisions

While clients must conduct a thorough benefit-risk analysis for consulting projects, especially those involving strategic elements, an often-overlooked aspect is the inherent limitations of confidentiality agreements. As highlighted by the 2022 Consulting Quest study, nearly half of clients do not systematically use Non-Disclosure Agreements (NDAs), potentially exposing themselves to risks of information leakage and competitive disadvantages.

Even when NDAs are in place, they have inherent limitations due to the human factor involved in consulting work. Consultants, being human, cannot simply ‘switch off’ their brains or erase their memories when moving from one client to another. While an NDA can legally protect a firm from having its strategies openly shared with competitors, it cannot prevent the subtle, often unconscious use of accumulated knowledge and insights in designing strategies for subsequent clients.

4. We Need Regulatory Oversight in Consulting

As we delve into the complexities of the consulting industry, one aspect that stands out is the conspicuous absence of a unified regulatory framework. While various professional associations strive to uphold standards within their regions, the lack of global synchronization leads to a fragmented landscape.

4.1 The Current State of Regulatory Oversight

The consulting industry, despite its global influence, lacks a unified regulatory framework. Around the world, several professional associations attempt to fill this gap. In the UK, there’s the Management Consultancies Association (MCA); France has Syntec; and the International Council of Management Consulting Institutes (ICMCI) represents a network of country-based organizations.

Each of these bodies works towards developing charters and best practices within their respective regions. However, there is a noticeable absence of synchronized, global efforts, and these associations often lean towards the interests of large consulting firms, which are their primary funders.

4.2 The Consequences of Limited Regulation

The lack of a comprehensive, globally aligned regulatory body leads to varied ethical standards and inconsistencies in service quality across the industry. This fragmentation makes it challenging to effectively manage conflicts of interest and maintain uniform standards of professional conduct. The absence of a universal regulatory framework also limits the ability to enforce these standards effectively.

4.3 The Role of Industry Associations

While industry associations like the MCA, Syntec, and ICMCI play a crucial role in their regions, their efforts often remain isolated, without a cohesive global strategy. These associations focus on establishing ethical codes and best practices, but their impact is limited by their regional scope and the influence of major funding firms.

4.4 ISO 20700: A Step Forward but Not Enough

The introduction of ISO 20700 in 2011 marked a significant step towards standardizing management consultancy services. Following the line of ISO 9001, it provides guidelines for effective service delivery, including managing conflicts of interest. However, its scope is informative and non-binding, reducing its effectiveness as a regulatory tool.

Moreover, while ISO is influential in the EU, its impact and adoption are less pronounced outside of Europe, further highlighting the need for a more universally recognized and enforced standard.

4.5 Collaborative Efforts for Enhanced Regulation

There is a critical need for collaborative efforts to develop a more standardized and globally recognized regulatory framework. This collaboration should include professional associations, consulting firms, clients, and potentially a new global governing body.

Such an effort could lead to the development of universally accepted certifications, performance metrics, and an industry-wide ethical charter. These measures could significantly enhance the industry’s credibility, improve service quality, and effectively manage conflicts of interest on a global scale.

5. Learning from Other Sectors: Approaches to Conflict Management

Conflicts of interest pose a universal challenge across industries, each addressing it with unique mechanisms shaped by ethical standards and regulatory frameworks. The legal sector, for instance, enforces firm-level recusal in conflict situations, backed by the threat of penalties and license loss. This article delves into how various sectors handle these ethical dilemmas and what the consulting industry can learn from them.

5.1 The Legal Industry’s Approach to Conflicts of Interest

In the legal field, conflicts of interest are navigated with utmost seriousness. When a conflict arises, it’s not just individual attorneys but the entire firm that often steps away from the case. This rigorous approach is underpinned by a strong regulatory framework. Law firms risk severe penalties, including loss of licensure, for non-compliance. Such stringent measures underscore the high value placed on ethics and client trust in legal practice.

5.2 The Medical Field and Patient-Centric Ethics

The medical sector, guided by the principle of ‘do no harm,’ places patient welfare at its core. Conflicts of interest, especially in patient care and clinical research, are managed with an emphasis on patient rights and informed consent. Regulatory bodies and medical ethics committees play crucial roles in ensuring that healthcare decisions are made without personal or institutional bias, maintaining the integrity of medical practice and research.

5.3 Financial Services and Regulatory Compliance

Financial services, a sector profoundly impacting consumer trust and market stability, manage conflicts of interest through stringent regulatory compliance. Entities like the SEC enforce transparency and ethical practices, ensuring financial advisors and institutions uphold their fiduciary duties. This framework mandates that client interests are prioritized, fostering a trust-based relationship between financial professionals and their clients.

5.4 Academia and the Pursuit of Unbiased Knowledge

In academia, the integrity of research and publication is paramount. Conflicts of interest are addressed through mechanisms like peer review and funding disclosures to maintain transparency and objectivity. Academic institutions implement policies to ensure research is conducted without bias, fostering an environment where knowledge advances based on merit and factual accuracy.

The methods of managing conflicts of interest vary across industries, but the commitment to ethical integrity and regulatory oversight remains a common thread. By examining these approaches, the consulting industry can gain insights into enhancing its own practices. Embracing rigorous ethical standards and clear regulatory guidelines could mark a significant step towards fostering greater trust and accountability in the consulting world.

6. The Limitations of Chinese Walls in Consulting: Why They Aren’t Enough

The consulting industry, characterized by its lack of a regulatory framework and standardized ethical obligations, often relies on internal measures like “Chinese Walls” to manage conflicts of interest. However, the effectiveness of these measures is increasingly being questioned.

6.1 Understanding the Concept and its Application

‘Chinese Walls’ in consulting refer to internal information barriers designed to prevent the exchange of client-specific knowledge that could lead to conflicts of interest. Originally from the financial sector to prevent insider trading, these barriers segregate teams or departments to safeguard sensitive information. However, their application in the consulting world is fraught with challenges.

Consulting firms deploy Chinese Walls by establishing strict rules about information sharing, anonymizing shared knowledge, and ensuring practices are compliant with internal guidelines. For instance, consultants working for competing clients in the same industry might be segregated to prevent the flow of strategic information between teams.

6.2 The Challenges of Enforcing Chinese Walls

Implementing effective Chinese Walls in the consulting industry presents significant challenges. The fluid nature of consultancy, where knowledge transfer is a key asset, complicates the maintenance of strict informational barriers. The reliance on individual consultants’ discretion, coupled with the difficulty of monitoring every exchange of information, makes these walls less effective than intended.

A critical aspect of this challenge lies in the position in which consultants find themselves. Consulting firms often require consultants to work on similar strategic topics for different companies within a short timeframe. This expectation places consultants in a profound ethical dilemma: should they protect the confidentiality of their previous client at the expense of not fully leveraging their expertise for their current client, or should they apply all their knowledge, potentially jeopardizing the interests of the former client?

This dilemma is not just a matter of professional discretion but also a question of ethical fairness. Expecting consultants to independently navigate this complex terrain without clear guidance or support is unreasonable. It places undue stress on the individual consultant, who must balance their professional integrity with the demands of their current engagement.

6.3 Case Study: McKinsey and the Opioid Crisis

A recent scandal involving McKinsey & Company in the opioid crisis highlights the limitations of Chinese Walls in consulting. It was revealed that consultants from McKinsey were simultaneously working for the FDA on opioid regulations and for Purdue Pharma to get their drug OxyContin approved. This egregious conflict of interest was uncovered in an investigation by the US House Committee, which found that McKinsey not only staffed at least 22 consultants at both the FDA and opioid manufacturers on related topics but also leveraged their federal connections to secure business and tried to influence public health officials.

This case demonstrates the profound impact of conflicts of interest, where consulting work potentially influenced key decisions affecting public health and safety. It underscores the need for more stringent measures to manage these conflicts and protect the public interest.

6.4 Exploring More Effective Solutions

The reliance on Chinese Walls, and the undue burden it places on consultants, points to their inadequacy in effectively managing conflicts of interest. There have been instances where these internal barriers have been inadvertently breached, leading to ethical dilemmas and a loss of client trust.

In response, the consulting industry must seek solutions beyond the concept of Chinese Walls. Drawing lessons from regulatory practices in law and finance, the consulting sector could benefit from adopting standardized ethical codes and considering regulatory oversight. Such measures could provide a more robust and transparent framework for managing conflicts of interest.

Implementing these changes would not only enhance the integrity of consulting services but also provide consultants with clearer guidelines and support in managing these ethical challenges. By shifting the focus from individual discretion to a structured, industry-wide approach, consulting firms can better equip their consultants to handle the intricate ethical dilemmas they face in their work.

7. What Consulting Firms Can Do to Build a More Ethical Industry

Consulting firms are uniquely positioned to pioneer ethical practices within the industry. The creation of a co-authored charter of good practices is a critical step towards this goal. This charter should comprehensively address conflicts of interest, setting clear, industry-wide standards that promote integrity and transparency.

7.1 Proactive Prevention of Ethical Dilemmas

To prevent consultants from facing ethical dilemmas, consulting firms must take proactive steps beyond the drafting of a charter. This involves:

Training and Awareness: Regular training sessions should be conducted to ensure that all consultants are aware of the ethical implications of their work and understand how to navigate potential conflicts of interest.

Transparent Communication with Clients: Firms should adopt a policy of transparency with clients, openly discussing the measures taken to avoid conflicts of interest. This transparency allows clients to make informed decisions and trust the integrity of the consulting services they receive.

Ethical Decision-Making Framework: Firms should develop a framework to guide consultants in ethical decision-making. This framework can include practical steps to assess and address potential conflicts, ensuring consultants are not left to struggle with these issues independently.

7.2 Role of Chief Compliance or Ethics Officers

The appointment of Chief Compliance or Ethics Officers is a significant measure to ensure the adherence to these ethical standards. Their responsibilities should extend to:

Monitoring Compliance: Regular audits and reviews should be conducted to ensure that the practices align with the charter’s guidelines and industry standards.

Measuring Outcomes and Adjusting Policies: The effectiveness of the policies should be periodically evaluated, with adjustments made as necessary to address emerging challenges and maintain high ethical standards.

Ad-hoc Committee for Conflict Assessment: In instances where a potential conflict of interest arises, an ad-hoc committee should be formed to evaluate the risk to the firm’s reputation and client relationships. This committee can provide an objective assessment and recommend the best course of action, ensuring that decisions are made in the firm’s and clients’ best interests.

By adopting these measures, consulting firms can ensure that their consultants are well-equipped to handle ethical challenges, thereby reinforcing the trust and credibility of the consulting industry as a whole.

8. How Clients Can Help Change the Consulting Industry for the Better

Clients are pivotal in steering the consulting industry towards ethical practices. Their approach to engaging consulting services can significantly influence how conflicts of interest are managed.

8.1 In-Depth Analysis Before Engagement

Clients should rigorously assess whether to develop solutions in-house or seek external consulting services. This analysis should include an evaluation of confidentiality risks, weighing the benefits of external expertise against the potential exposure of sensitive information. Such a detailed assessment aids in making informed decisions that align with the client’s strategic interests and confidentiality concerns.

Beyond the make or buy decision, clients should thoroughly vet the expertise and past engagement history of consulting firms. This includes understanding the firms’ previous work with competitors or other parties where conflicts of interest might arise.

8.2 Ensuring Transparency and Ethical Commitment

In their Request for Proposals (RFPs), clients should require consulting firms to explicitly declare any potential conflicts of interest. This practice ensures that firms are upfront about any existing or potential conflicts, facilitating transparency and ethical accountability.

Alongside conflict of interest declarations, clients can also require consulting firms to sign declarations committing to ethical practices. This adds an additional layer of commitment to ethical standards.

8.3 Legal and Contractual Measures

Master Service Agreements (MSAs) and contracts with consulting firms should include specific clauses that address conflicts of interest. These clauses should clearly state the responsibilities and expectations concerning conflicts of interest, as well as define the sanctions for non-compliance.

The inclusion of these clauses must be accompanied by a willingness to enforce them. Clients should be prepared to act on the stipulated sanctions in case of any breach. This active enforcement serves as a deterrent against unethical practices and underscores the seriousness with which clients approach conflicts of interest.

8.4 Ongoing Vigilance and Relationship Management

Clients should maintain ongoing communication with consulting firms throughout the engagement, conducting regular reviews to ensure compliance with ethical standards.

Closing Thoughts

By prioritizing relationships with consulting firms that have demonstrated a strong commitment to ethical practices, clients can foster a culture of integrity within the industry. This approach encourages consulting firms to maintain high ethical standards in order to secure long-term partnerships.

As we conclude our examination of conflicts of interest in the consulting industry, it’s clear that the ethical challenges go beyond surface-level conflicts. Mixing audit with consulting or private equity with consulting raises questions not just about ethics but strategic wisdom. The dual role of consultants in organizational transformation and executive compensation adds complexities, as does collaboration with foreign nationals on matters affecting national sovereignty. These intricacies underscore the need for a robust framework.

While these dilemmas pose profound questions, the ultimate resolution lies in the hands of governance bodies to define a clear and comprehensive framework. Until such regulatory measures are enacted, the onus rests on both consultants and clients to cultivate and uphold ethical practices. In this collective endeavor, the consulting industry has the opportunity not only to navigate conflicts of interest but to redefine itself with a steadfast commitment to integrity, transparency, and the best interests of all stakeholders involved.